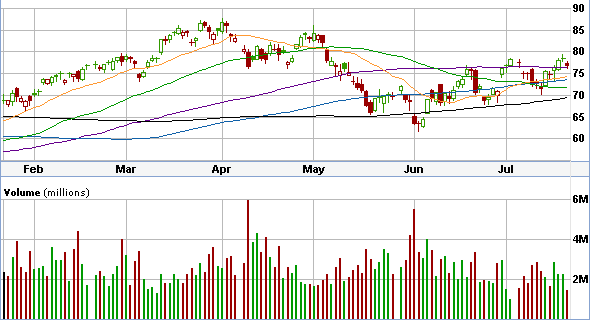

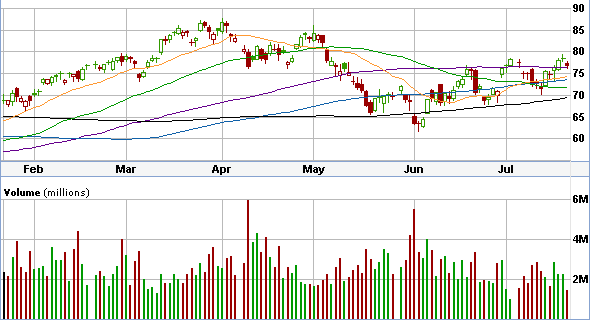

So, patience paid off today as the S&P failed the 100 day support (purple line) or, the 1375 level that everyone refers to. Many traders were out to short at 1375 but, like I always say, on this site we take the traditional approach to investing. That means we don’t try to time the market because, most of the time, people fail in doing so. If it were so easy to short at 1375, which my 5 year-old nephew could figure out, everyone would do it. It worked today but the market is way to volatile to predict right now. So we are simply in 90 % cash waiting for the smoke to clear. There is plenty of time to jump aboard a bull market. We sold RIG today for a 7% gain and switched into SLB, who just reported solid earnings- reaffirming once again that they are the premier energy services company to own. We also sold MCD for a small gain. Our positions are now as follows with beta being proportional to our position size: UPRO SLB ETP VMW MOS FCX MS TEX NOG. Our analysis of each company to follow later tonight. See Portfolio Core Holdings.

So, patience paid off today as the S&P failed the 100 day support (purple line) or, the 1375 level that everyone refers to. Many traders were out to short at 1375 but, like I always say, on this site we take the traditional approach to investing. That means we don’t try to time the market because, most of the time, people fail in doing so. If it were so easy to short at 1375, which my 5 year-old nephew could figure out, everyone would do it. It worked today but the market is way to volatile to predict right now. So we are simply in 90 % cash waiting for the smoke to clear. There is plenty of time to jump aboard a bull market. We sold RIG today for a 7% gain and switched into SLB, who just reported solid earnings- reaffirming once again that they are the premier energy services company to own. We also sold MCD for a small gain. Our positions are now as follows with beta being proportional to our position size: UPRO SLB ETP VMW MOS FCX MS TEX NOG. Our analysis of each company to follow later tonight. See Portfolio Core Holdings.

So, patience paid off today as the S&P failed the 100 day support (purple line) or, the 1375 level that everyone refers to. Many traders were out to short at 1375 but, like I always say, on this site we take the traditional approach to investing. That means we don’t try to time the market because, most of the time, people fail in doing so. If it were so easy to short at 1375, which my 5 year-old nephew could figure out, everyone would do it. It worked today but the market is way to volatile to predict right now. So we are simply in 90 % cash waiting for the smoke to clear. There is plenty of time to jump aboard a bull market. We sold RIG today for a 7% gain and switched into SLB, who just reported solid earnings- reaffirming once again that they are the premier energy services company to own. We also sold MCD for a small gain. Our positions are now as follows with beta being proportional to our position size: UPRO SLB ETP VMW MOS FCX MS TEX NOG. Our analysis of each company to follow later tonight. See Portfolio Core Holdings.

So, patience paid off today as the S&P failed the 100 day support (purple line) or, the 1375 level that everyone refers to. Many traders were out to short at 1375 but, like I always say, on this site we take the traditional approach to investing. That means we don’t try to time the market because, most of the time, people fail in doing so. If it were so easy to short at 1375, which my 5 year-old nephew could figure out, everyone would do it. It worked today but the market is way to volatile to predict right now. So we are simply in 90 % cash waiting for the smoke to clear. There is plenty of time to jump aboard a bull market. We sold RIG today for a 7% gain and switched into SLB, who just reported solid earnings- reaffirming once again that they are the premier energy services company to own. We also sold MCD for a small gain. Our positions are now as follows with beta being proportional to our position size: UPRO SLB ETP VMW MOS FCX MS TEX NOG. Our analysis of each company to follow later tonight. See Portfolio Core Holdings.