As we took profits last week and rebalanced the portfolio, we began salivating at the mouth waiting for our stocks to pullback. As I am trepid about the market being this extended, I also feel that we must be prudent in buying uptrending stocks. We got the pullback to the 20 on some, so here is what we are doing:

– Adding back to TEX at the 20.

– Repurchased MTRN on the pullback, hoping this rare metals company will continue to benefit from qe3.

– Sold GE for an 8% gain + received diviend ex-date 9/20/2012

– Purchased more calls on PHM. This sector is making huge moves due to qe3 twist of buying home mortgages.

– Bought Key Bank (KEY) because of it being a double play- financial exposure + heavy exposure to housing.

– Repurchased FCX. Waiting to purchase more calls on XME for added leverage and not risking long term capital if this is the top.

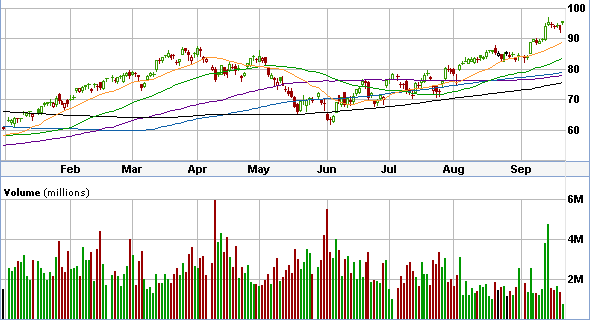

Terex Chart (TEX) Pullback to the 20 (orange line). Stock is at resistance however from prior highs during the year despite it being above all moving averages. So that is why we are experimenting with this stock rather than others in the portfolio that look the same. ( It reported solid earnings and is not far from support at 20. We like this one RHRN- right here right now).

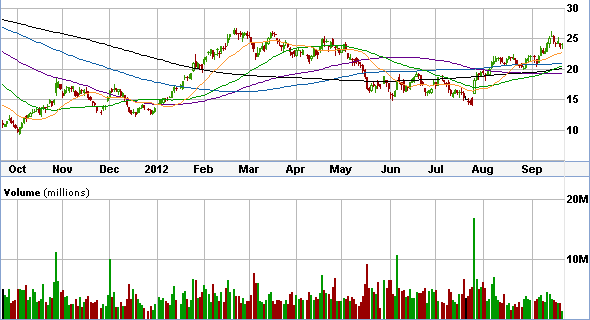

We are essentialy in 90% cash again. We are bullish on the stock market but are a little nervous at these extended levels. We got the pullback we were looking for in some stocks and added to those but, we are staying predominantly in cash until we see that this bull market is for real. S&P 500 (overall market) below: