If you are an avid follower of Wsss.com, you would know that I like technology names because of their positive correlation to an expanding economy (remember that industrials, tech, and finance should all be owned in a rising rate environment). However, anything growth related has been hammered lately as investors are taking risk off the table, anticipating a slower economy.

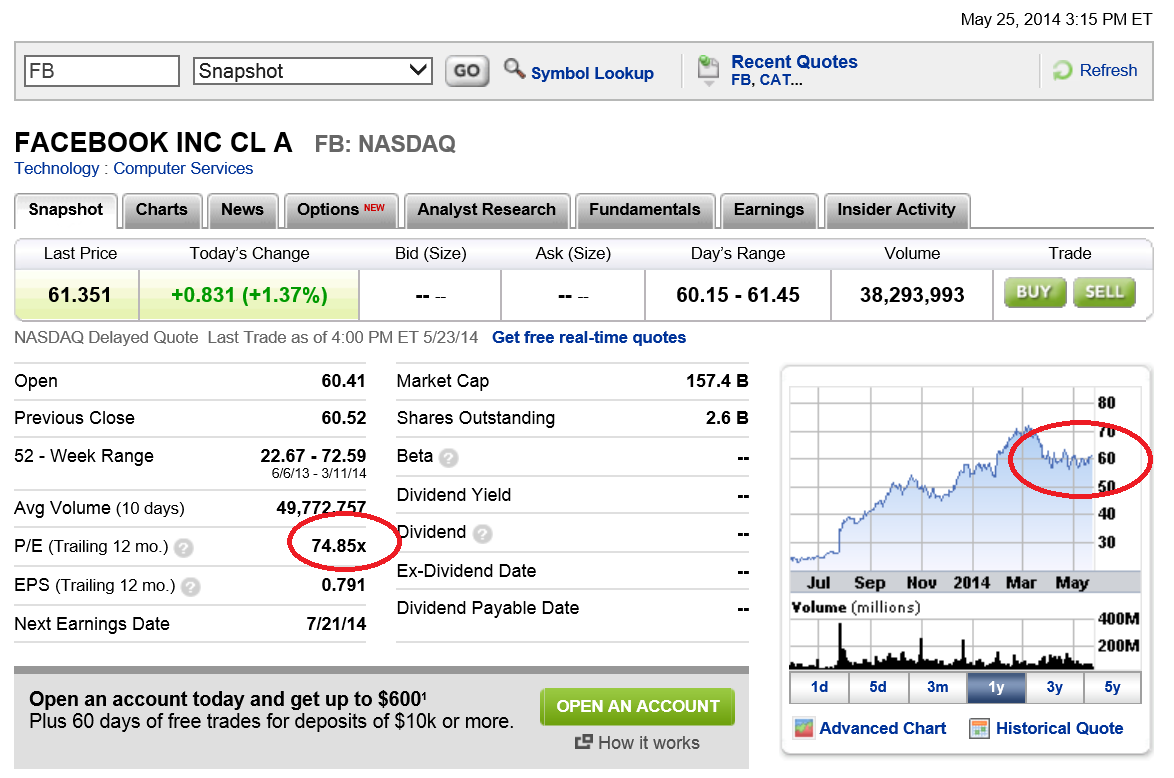

Well, even with a slower economy, some of these growth stocks are becoming too cheap to ignore. Even though $FB trades at over 75x earnings, 60% year-over-year robust growth makes valuations particularly attractive. Plus, social media is still an area that Wall Street can’t really quantify, or measure, because there is no standard in place to compare vs. historical norms.

Perhaps the biggest reason why I am liking Facebook $FB shares is because of the strong technical setup that we are seeing. It has been consolidating nicely between the $57-$60 dollar range and just has the 100 day moving average to clear (resistance- white line).

If the S&P 500 ($SPY) moves higher, I believe this social media stock can clear resistance and is worth buying- again (I liked $FB back at $30.00 and wrote about it). The stop-loss goes in at 54.90.

Update June 10th, 2014: $FB Jumps 4 Points

Up 3% the next day of trading. Still room to run, but $SPY needs to continue uptrend. Regards.