Covid tried to break me. It was this close to being successful; my account plummeted from around $250,000, down to $15,000.

But, leverage kills. I had to raise the stakes, though, and increase my margin debt up to more than a half a million in order to support my new baby boy, Todd Jr., and to pay for the house that my Dad helped me to get- for Todd Jr.

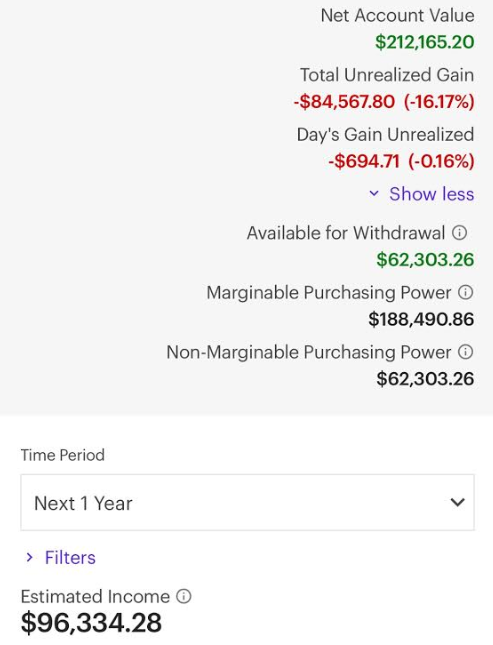

Below is my account value before the crash and the yearly income that I was earning, which was almost 100K per year.

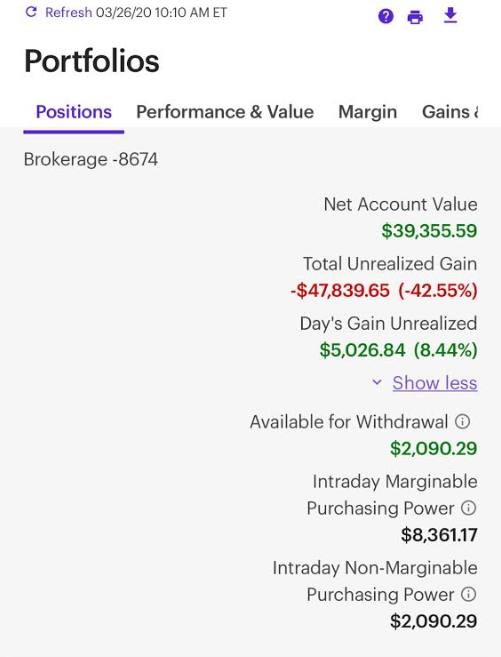

Then below is a picture capturing what my account ultimately fell to. It was the only image I could find considering the mayhem. But, intraday, my account actually went much lower than what is shown. What you see below was actually just after the market bottom.

So, How Did I Make The Comeback?

Many people bought into the fear, thinking that Covid was real. I and a few others on CNBC knew this wasn’t the case. To be clear, we knew that Covid was, and is, REAL; but it’s not something that should warrant the level of fear and economic turmoil that the world is now engulfed in 24 hours a day.

This is because covid is just a cold. It says so on the CDC website. I don’t have to cite anything either because this is my site and I don’t take orders from anybody, including Seeking Alpha.

Anyway, some years covid (or corona) is worse for people than others. We have all been through it. I repeat, that doesn’t mean we should shutdown an entire world economy and ruin people’s livelihoods in the process.

On top of the gross misreporting of what covid actually is, deaths were tied to pre-existing conditions, numbers were being inflated 10x over in states like Florida, hospitals were classifying all admitted patients as covid patients in Houston regardless of diagnosis, hospitals across the nation were empty in many cases, and people who tested positive were considered new cases until they were cured. These were just SOME of the distorted numbers perpetuated by the media.

So, it would only be a matter of time before analysts caught onto this massive disconnect in the data, I figured. Even if we lost $4 trillion in GDP, we gained $12 trillion in stimulus to more than offset the deficit.

Anthony Scaramucci loved this line and repeated it on air ad nauseum. But, it’s a valid point. I also caught on to how S&P 500 companies would just get stronger, as more small businesses would fail, and trends towards digitization, automation, and consolidation would accelerate to work in favor of big tech and the top corporations in the S&P 500.

Even with the violent comeback in the portfolio, I believe the market is STILL going higher (even under Biden and without more stimulus).

This is due to the fact that the S&P 500 (the market) has averaged a 7% gain per year since it’s inception. Any dip should be bought, in other words, unless America is overtaken by another super power, and capitalism as we know it ceases to exist.

Another point I find odd is that no one can ever figure out whether to buy the dip or not. Every dip should ultimately be bought because of the stat listed above. Instead, people let the media convince them otherwise, keeping them in a quite state of desperation their entire lives.

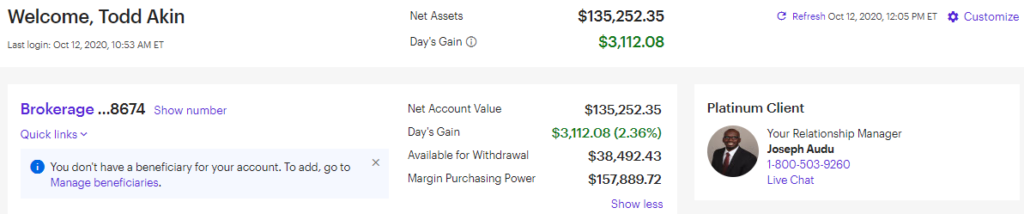

Thankfully, for various reasons including government aid, I was able to get my bank roll back up to about $50,000, which then helped propel me back to $135,000 (as of October 12, 2020), seen below.

My pivotal, life-changing decision of switching strategies, particularly as it pertains to going from long term investing (collecting capital gains), to passive income, also served me well during the crisis.

The change in not only my market strategy, but total life-thinking, resulted in advantages gained that I never experienced before, such as padding my portfolio with much needed income to pay my debt down and stave off margin calls during corona, which was one of the toughest market situations I’ve ever been through (and I went through 08′).

More importantly, switching to passive income not only saved me during corona, it gave me QUALIFYING INCOME, which is how my Dad agreed to help me purchase the house for Todd Jr. in the first place.

Whether it be from my idol (my Dad), or a bank, qualifying income is the key to surviving the wicked game of capitalism.

People don’t know certain information about capitalism that can mean the difference between financial life and death, because they weren’t taught these basic principles in schools, including prestigious colleges.

I attended Bauer, a top ten business school in Houston for example, and believe me, I never learned this stuff…

Like cash is trash due to low interest rates, or debt is good when used properly, and 401Ks are traps since you can’t withdraw money and actually use it in life until your are too old to matter (that’s assuming the market didn’t crash and bring your investment values down to such a low point that you have to postpone retirement anyway, like my grandparents).

But more on those topics later.

Conclusion

For now, I can’t let the momentum gained from the corona recovery be lost. So, I will use this site going forward to post all of my lessons learned from Corona, to keep readers informed on the markets, and, most importantly, to keep myself accountable to my portfolio again, which is what brought my readers, and I, so much success in the past.

Stay tuned for updates.