The portfolio continues to make new highs. People would attribute the gains to lower interest rates, death of mom-and-pop stores leading to market share gains for S&P 500 companies, higher inflation, government stimulus, vaccine availability, and many other factors.

But, even bad news is good news in this ‘roaring 20’s’ bull market. For example, rising rates, which is supposedly bearish, is actually good and necessary to keep “worrisome” inflation down. While, ironically, higher inflation is good for the economy, when sustained around 2%.

It is usually when both inflation and interest rates get to around 4-5% that things get shaky, leading to the subsequent market declines witnessed in years past. So, what can one really attribute the gains to?

Whichever reason the market continues to rise (or fall), it is always a meaningless endeavor to pontificate since the S&P 500 simply goes up 7% a year, on average, since inception. This means crashes are rare, and all dips should be bought. Capitalism is why the S&P 500 always wins.

Here is a recent chart below of the S&P. The uptrend remains strong, as usual.

So, instead of wasting time on rationalizing why the market is up/down, or forecasting where it will go, I prefer thinking beyond the average “buy and hold” mindset, and am approaching the market differently through targeting various income opportunities, such as writing options and collecting dividends, through margin, while still collecting the capital gains everyone so desperately seeks, regardless of market conditions.

Completely Change Your Approach To Making Money

Pure capital gains through trading stocks are my least favorite way of making money since you are taxed significantly, it is not easy to repeat statistically when 90% of traders can’t beat the S&P 500 and, most of all, because capital gains don’t get you far in life; you can’t just withdraw 20% from you’re brokerage account for a down payment on a house, I have tried.

You need “qualifying income” as well, which is why I prefer dividends and options as my optimal vehicles for making money, regardless of market conditions.

Capital gains become just a plus when up, and a meaningless number when down, since you have dividends, option premiums, and hopefully crash insurance in the form of SPY put options to lessen the blow of market declines.

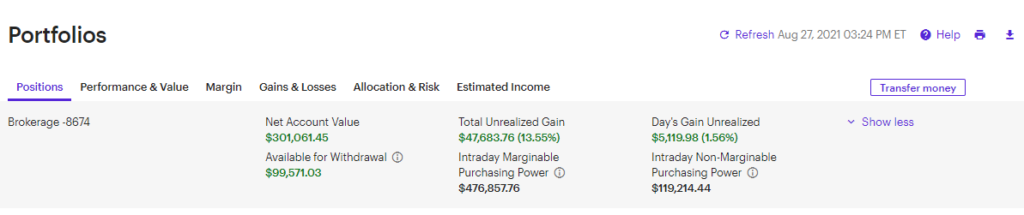

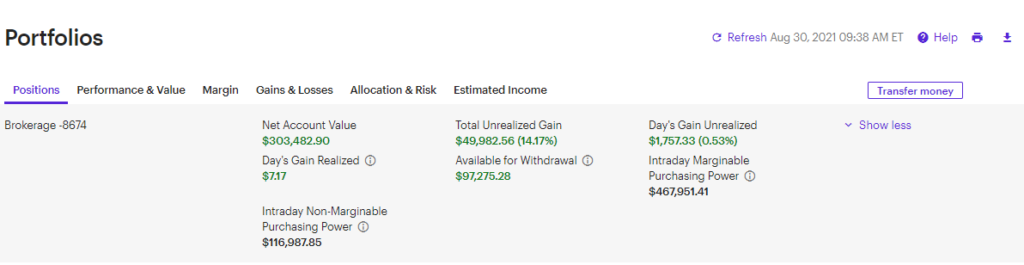

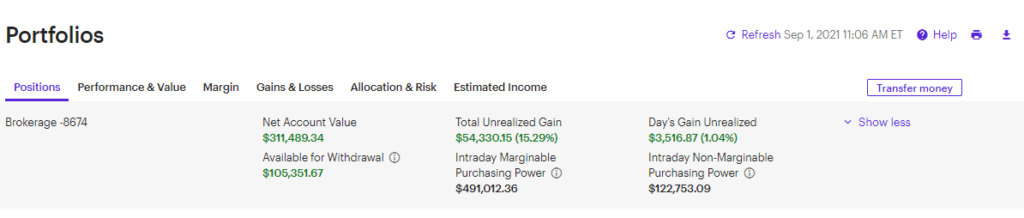

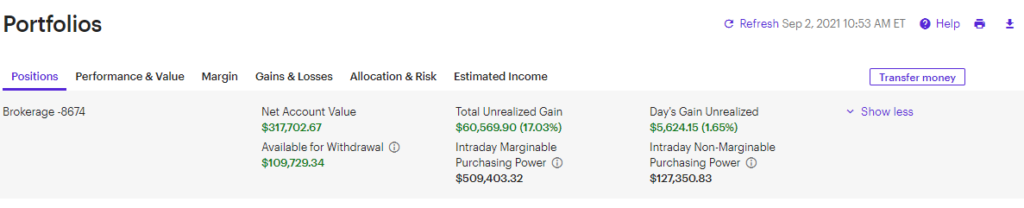

Even with my somewhat-conservative, income-oriented strategy, my capital gains are still significant on a daily basis, as seen below.

The daily fluctuations range anywhere from $1,000- $6,000 on a given day, with a 1% increase in the S&P being a $3,000 capital gains increase for me, generally, on a $300,000 account.

As long as I am performing with the major indices through proper diversification AND I am using the right allocation amounts to each sector/theme in the S&P 500 (on the dividend side of the portfolio), while then utilizing my equity in the background to write options on the growth side of the portfolio, aiming to match the Russell 2000 with those, I can get the best of both worlds: tax-free income and capital gains growth, at almost a delta of one to the S&P 500 and Russell 2000, respectively.

These Options Plays Are Different…

I’m loving this “newer” way of earning money through dividends and option premiums. Newer because let’s face it, margin rates were never this low in the past, and these growth companies were not as established then as they are now; the premiums are quite high and stable, as a result.

What’s great about writing options is too difficult to say in one paragraph, but I’ll try to list a few reasons below:

1.) The holdings are high flyers, disruptive to current industries, and are fully diversified across all 12 sectors for added safety and performance (again, pegged to the Russell 2000).

2.) The premiums targeted are always in the 20% range, where I receive about $500 on average, instantly, upon writing the put option. That’s better than most people can do in stocks, statistically, and I am taking minimal risk by not even owning the positions yet.

3. Writing options gives added margin of safety, especially when I am setting the strike prices way down out of the money.

4.) Getting assigned down at my strike price would be a blessing on many of these names, since I can make much more money on the cap gains side of growth names when at the bottom, with potentially 100% home-runs that compound wealth faster than dividends.

5.) If I have enough positions (currently around 75) then the law of averages helps ensure success. I am not just talking every-day diversification, here. More on diversifying-differently in the next section…

6.) Last but not least, by setting puts so far out, you turn traditionally 3 beta growth stocks into 1 beta value stocks (especially at these depressed/highly attractive levels), greatly offsetting unwanted volatility that can occur with growth stocks.

Law Of (Moving) Averages

Back to the subject of re-thinking diversification, which challenges the traditional notion that 8-20 companies is the acceptable number to diversify a portfolio with.

This newer way for me is similar in theory to the Rockets and their old volume shooting system under D’Antoni. The more they shot, the more the professional’s averages of about 40%-50% on threes kicked in, and the Rockets won a lot of games, even though people doubted, in the beginning, new age “3 & D” analytics.

If a pro can shoot 100 3’s, then theoretically, a pro should drain about 40% of the shots, even if they miss 10-20 in a row to start. Law of averages should apply to these highly-professional companies as well, purely from a basis that they all wont go… not down…but BANKRUPT.

The strikes are so low on these great franchises and the premiums are so high (due to the recent pullback caused by the rotation from growth to value), that the companies would ALL have to go bankrupt for me to lose big. If I roll the puts lower, the new premiums combined with even lower strikes would mitigate risk further.

Even from a technical standpoint, I am placing the stops at significant areas on actual moving averages/old breakout levels, which should improve odds as well.

As you can see below, I sold a put on RIOT (bitcoin miner) at the key 200 day moving average (yellow line, around $35/share), but I also placed the put strike at $20 for added probability of success and about $800 in premiums (more than many people even make outright in bitcoin).

I also set all puts out until Jan 2023, since I am a long term investor, and want the exposure to those themes/sectors for at least one year, anyway.

Another key is to mix the young talent of the future (growth names) with old vets (S&P 500 names, and other large caps in major indexes) to stabilize the locker room (portfolio). Cathie Woods does this with her ARK funds, frequently.

A Lesson On Equity

From this point on, I just need to keep on swapping out my crash insurance with new puts and fresh expirations for the following month until the portfolio gets strong enough to operate without them, as well as monitor my equity more routinely than my actual margin balance (which is around $30,000), or my market value, (again, around $300,000). My equity currently stands at around $105,000 (seen in each of the images above).

The put positions on growth names are siphoning my equity, being 100% maintenance, and this is a cause for concern until my equity can grow large enough to adequately withstand downturns. Hence, crash insurance is a must for me.

For what it is worth, this is another reason why margin debt doesn’t necessarily matter (to all the ignorant who are wrongly intimidated by margin), because my margin is only 30K now (compared to over $200K before), whereas the amount of puts sold, or on the hook for assignment currently, is $150,000 (on mainly 100% maintenance names).

That means I can be dragged into a margin call at some future date, regardless of being in actual margin, should another Corona-style event occur.

This cherished equity cushion is why I like to use margin so frequently to invest in prized, 30% maintenance names (again usually found in large caps or the S&P), where most of my capital is anchored to.

In other words, the low-maintenance ratings assigned to high quality income or S&P names adds 3x more equity cushion than the high-maintenance Russell names, so that not only can I collect larger dividends through the use of margin, but I can then also afford to write options on the high-maintenance growth names, in return.

Conclusion

So, I will continue to monitor my equity levels (and not necessarily market value or margin balance), since equity levels are the only ratios worth monitoring when the portfolio positioning is set for the next calendar year, and no more than 2%-3% of the portfolio is being risked in any one growth stock.

Feel free to email me on any questions you may have at Akintodd48@gmail.com, and stay tuned for more updates.