The account is up bigger today than usual up days because I’m using the recent “bond panic” excuse as a means to buy the dip. But, this time I am doing so by concentrating the portfolio into the true winners from covid over last 12 months.

This re-allocation can make for monster returns, even when done with a conservative strategy of just equal-weighting your stocks/positions in properly diversified sectors (which we will discuss below).

The idea here is keeping position size small, but equal, in high-flying post-covid themes that are changing the world, and can act as inflation hedge to your portfolio (and life saver if a job is lost to autonomy, or outsourcing, let’s say).

Email me for my latest holdings at Akintodd48@gmail.com, and help on portfolio reconstruction for the “great reset” going forward. As leaders are saying right now, “build back better”. I say this can apply to portfolios in a post-covid era, as well.

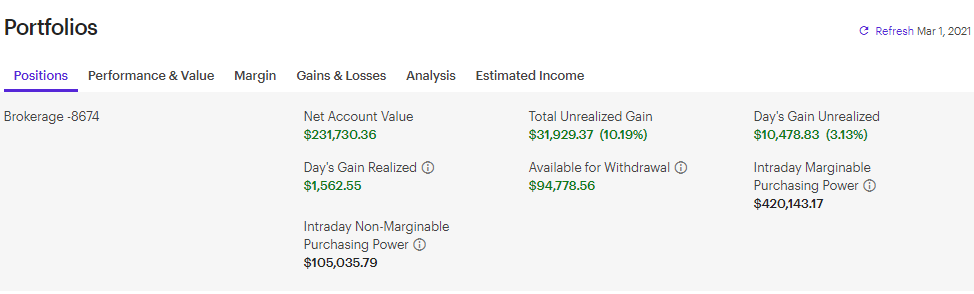

My portfolio has climbed from $130,000 to $230,000 in the span of few months, due to this new allocation towards a post-covid era. I suggest you do the same.

Again, we have to find someway to beat inflation, outpace wage stagnation, and have extra income in case of job loss or any unforeseen health issues that should arise. So, let’s work together during these challenging times to thrive, not just survive!

Bullish Market Outlook

The backdrop for investing has never been better as low interest rates and a 4th industrial revolution that is currently taking place compels investors to invest in stocks.

Throw out P/E multiples and book values in this kind of market; instead, stick with disruptive themes and their charts, while always having dividend income coming in to live on.

Just have basic sense of how high or low valuations are getting in order to decide proper allocation (aggressive, conservative, etc). You can determine this quickly just by looking at the charts of the 10 ETFs that comprise the entire S&P 500.

In essence, the market (the S&P 500, Russell 2000,etc) is comprised of 10 major sectors where all of the action takes place. Energy is one of those 10 sectors, and it still has room to run, so does real estate.

Now even tech has become cheap because of its recent dip, and it is on significant support which makes a bounce more likely.

Utilities are not a big component of the S&P 500, but they still are not even close to highs. So, in other words, these 4 sectors need to play catch-up to old highs, and would add fuel to any future rally.

Let’s see, that’s 4 sectors down 6 to go.

Expensive:

5.) Some Industrials

6.) Consumer cyclical

7.) Metals

Cheap:

8.) Staples

9.) Most Healthcare

10.) Many financials

Tech will always lead market because of its enormous market cap. So, if tech is indeed cheap right now, due to recent pullback to the 50 (white line), then it, along with the cheaper sectors listed above, can make for a sizeable move higher in the overall S&P 500, even as the 3 expensive sectors digest their recent gains.

If you just average the 10 sectors listed above together by their market caps and valuations, this scenario is what any sixth-grader would conclude.

However, Just Keep In Mind:

When corona began, everyone was bearish when I was bullish. The bear argument people were shouting from the mountain tops was, even if people get stimulus, they won’t spend it because of the shutdown.

I said, they would spend, because they would just spend online, and anyone who lost a job would have it replaced with the Amazons of the world (to counter the no jobs bearish argument as well).

“Be Fearful When Others Are Greedy”

Now, everyone is bullish because they think the economy will reopen with “pent up demand”. That’s usually the time to get more defensive.

I agree, for now, that people will go out again. However, PCR tests and restrictions could make some people become turned off to spending the way they used to, though.

I, for example, love to travel and go to sporting events. But, the restrictions can make for a more difficult time at planning and executing plans, which could hurt GDP going forward if others behave this way; unless customers find new ways to spend, i.e. online retail, etc.

Don’t Fall For “FOMO”

These exciting new tech companies WILL pullback with higher highs and higher lows as the economy reopens, because less online services will be needed.

So, don’t go crazy chasing the tech craze. You will have your spots to enter. That’s why I have people in hotels, casinos, and jets for now, but any dips in tech should be bought as it has changed our lives into a new-normal, forever.

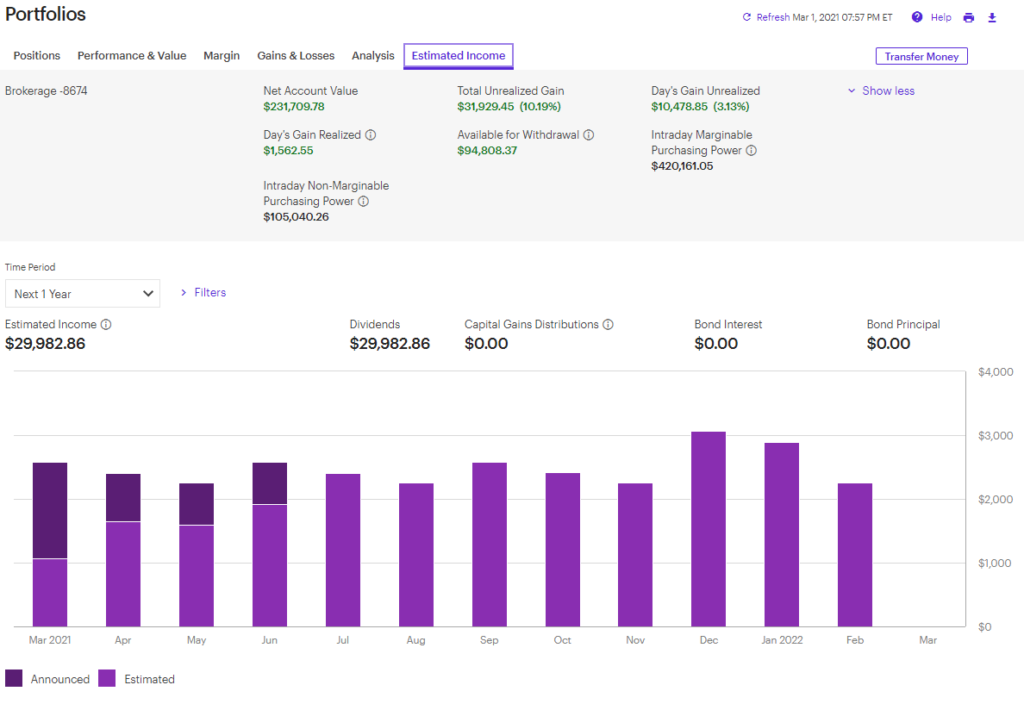

Monthly Dividends To Provide For Ample Cushion Should A Correction Arise

As one can see below, not only are capital gains like the $10,000 pocketed today needed to beat inflation and survive in a post-covid world, but so are monthly dividends. These timely payments can help keep the lights on and bills paid if the market turns against you.

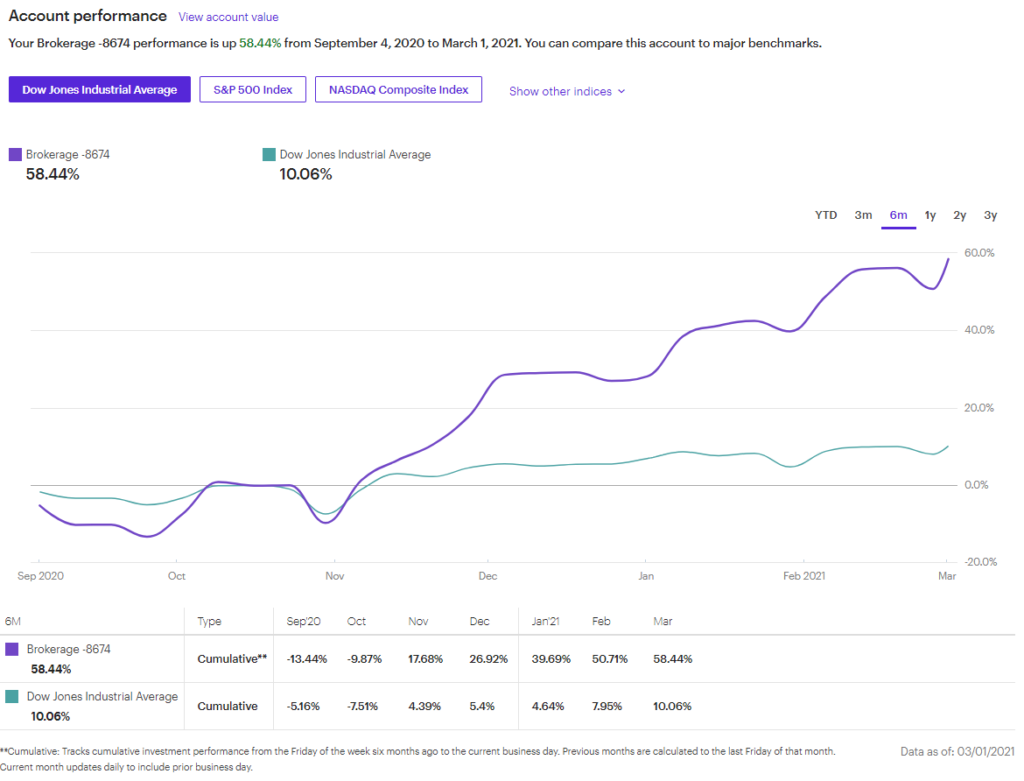

Performance has outpaced the S&P 500 year to date by almost 50%, as seen below. Let’s hope through proper portfolio management, this trend continues.