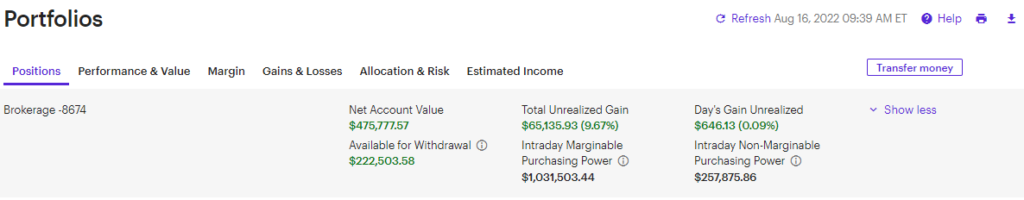

It’s not everyday that one gets to say that. In truth, a $500,000 account yields $2,000,000 in buying power. It’s just that, since I am already heavily invested, including being in over $200,000 margin, reaching $1,000,000 in buying power is still a remarkable feat.

As a result, I took the family on a trip to Boston last week to enjoy the fruits of our labor. I apologize for all of the pictures. But, I quit Seeking Alpha years back in order to have real freedom in my writing.

The return flight home; we were delayed in NYC. I talked to many pilots and they said conditions are improving, albeit at a slower pace than one would expect. It will take two years they said to train new pilots, as many were forced to retire during Covid.

Back to the discussion at hand…

So, even though these purchasing power numbers are eye-popping, the strategy doesn’t change. We are still relying on dividends to live on and paydown margin, with any daily gains just being icing on the cake.

Investing on Margin in Income-Producing Stocks is Like Real Estate… But Better

Because, again, we don’t care about price fluctuations. It’s the same concept as real estate investors: they take out the loan for let’s say $500,000 on a property, and let the renter pay it back in 15 to 30 years. This makes one agnostic to market price changes. After the 15-30 years, the $500,000 is yours free and clear. How else can one leapfrog their net worth any other way?

Any income coming after the mortgage is paid off in 15-30 years is free cashflow from that point on; or, playing with house money, as some call it, after catching a double at the casino. Except in stocks, the payback period is quicker, with less moving parts of a house.

Weekly Gameplan:

Since the market has had a huge run-up, and is now at the 200 day mavg (yellow line), we are starting a short position in the QQQs (SQQQ) and Nasdaq 100 (TECS), but only a strangle, where I am long 3:1 TECL:TECS and TQQQ: SQQQ, because I am biased to the upside.

Strangles are one of my favorite ways to manage risk to the downside while still participating in the upside in a meaningful way. If I’m wrong on the strategy, and the market goes higher, well then we still make a killing to the upside in our underlying holdings, since a rising tide raises all ships.

You can see below that any up day in the market produces pretty massive gains because our holdings are tied to the indexes, directly. This ensures strong market participation to the upside, and less pain to the downside (since indexes fall less than stocks, in general).

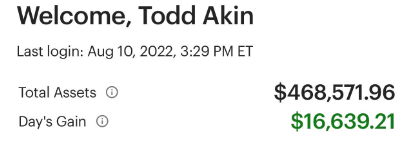

Hey, I’ll take $16,000 in a day, any day, especially when it is done with conservative index-related investments.

We will also look to sell puts on any major weakness to gain some extra premium, and knockdown margin even further in the process.

Updates to Follow!

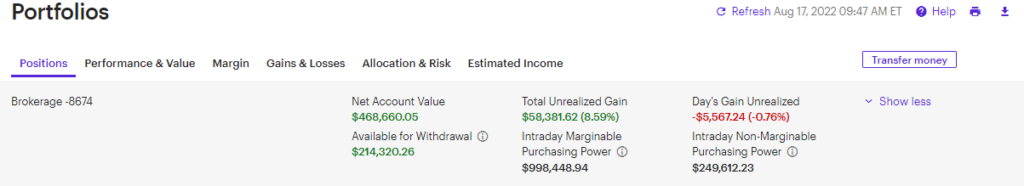

Wednesday, Aug 17th

As the market pulls back at resistance of the 200 day mavg (yellow line, seen below), we are down about $5,000 on the day. This should not deter us from our strategy of buying and holding dividend-producing names.

The $200,000 + margin we are holding is only costing me 3% in interest annually, so why sell just to take the gains? We will lose the precious income to live on, have to pay short term taxes on those gains (which are costlier than long term tax rates), and we aren’t getting charged enough in interest on the margin to matter anyway. So, stick to the gameplan!

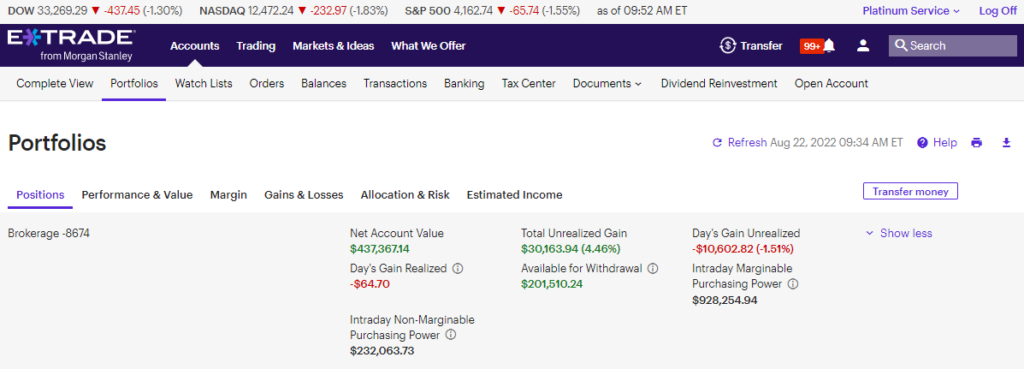

Update: Monday August, 22

We are looking at two charts below. The chart above is a one-year timeframe. The chart below is a one-day timeframe. The S&P 500 has now reached the 100 day mavg (blue line), after failing resistance of the 200 day mavg (yellow line).

Anytime you can outperform the index, up or down, you should be proud. We have already had our fun in the form of taking a needed vacation. I was also able to buy some new gifts for the house (see rose quartz tree below).

So, what else can one do except take profits in shorts and collect dividends while the market resumes its uptrend? Updates to follow!

Update- Taking Profits Where We Can to Raise Cash

Selling some lower paying dividend energy names to raise cash. They were a small percentage of the portfolio but $600 + in a month on some low-risk, high quality names never hurts. Will redeploy into higher yielding names on the overall market drop to the 50 day mavg today.

Just know to buy the names on your shopping list aggressively while the S&P 500 is at this all-important moving average (white line seen below). But, place your stop losses below the key support area.

Updates to follow!