S&P 500 Left: Holding 50% retracement level- bullish. Right: S&P 500 coiling in between major moving averages- neutral (expect a big move either way in next few days).

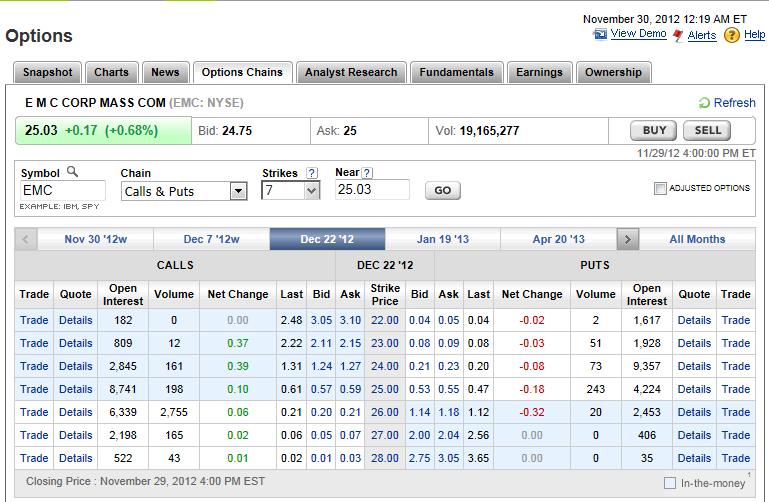

Freeport FCX is down 15% and counting today on a leveraged buyout of McMoran Exploration and PXP minerals. They are making a bigger move into the oil & gas markets but not taking focus away from mining business. I like the deal but investors seem to disagree, with the stock still not finding much support. So, instead of committing long term capital to FCX and getting our hinds tied behind our backs as the market wrestles with the logic of the deal, we will buy call options as a way to gain more leverage on FCX and play the short term bounce that we expect to come in the near future.

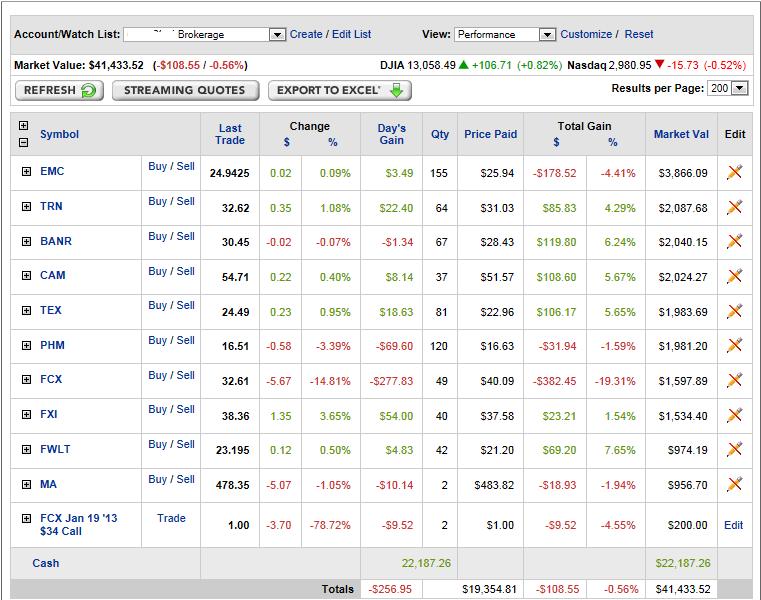

Here are the additions to the portfolio: To reduce beta and diversify risk, we sold out of the S&P 500 yesterday for a small gain to raise cash for our other core holdings. We bought Mastercard (MA) as we like the secular themes in going from paper to plastic. More on Mastercard later. There is our FCX call at the bottom. We took a small nibble here and will add to shares on a decline into the close. We will also add if the stock hits 30.00 – the 3 year line in the sand.