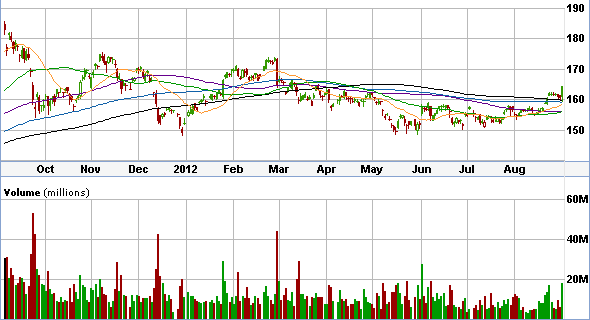

Gold looks good here. We just reported that China growth slowed even further in August and is threatening to be the next event to bring down the market. Gold has been in time out since March due to low inflation levels and the perception that the Fed was not easing in the near future. But now that there could be the coordination of central banks to aid Europe, China contemplating rate cuts, the Fed doing another round of quantitative easing, a weaker dollar, and by gold in its nature being a safe haven asset from a bad economy and war (Syria), portfolio managers might have enough reason to start accumulating the precious metal again. Look at the dead on chart below.

Gold looks good here. We just reported that China growth slowed even further in August and is threatening to be the next event to bring down the market. Gold has been in time out since March due to low inflation levels and the perception that the Fed was not easing in the near future. But now that there could be the coordination of central banks to aid Europe, China contemplating rate cuts, the Fed doing another round of quantitative easing, a weaker dollar, and by gold in its nature being a safe haven asset from a bad economy and war (Syria), portfolio managers might have enough reason to start accumulating the precious metal again. Look at the dead on chart below.

Gold has a break above the 200 on nice volume. The 20 (orange line) crossed above 50 and 100, (extremely bullish) and has spent its time in correction mode. It is a high quality asset that is due- especially since the fundamentals now support it again.

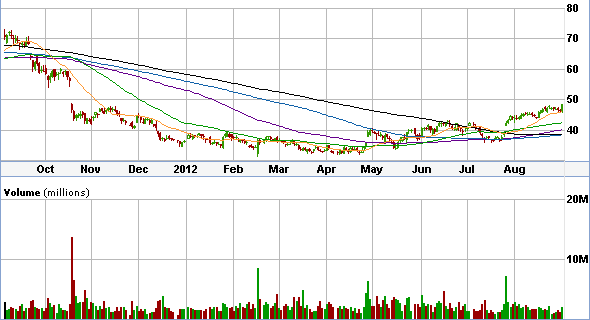

AEM (Below)

AEM- textbook buy. More risk than an etf (like gld above). Next stop 60.