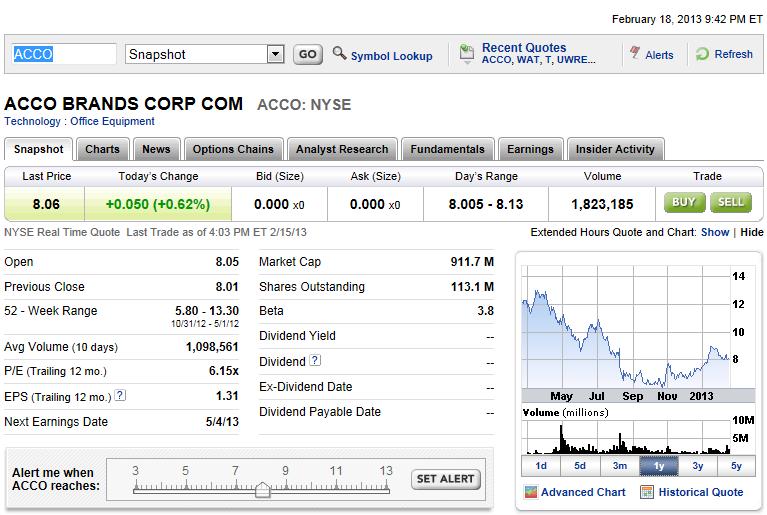

ACCO Brands (ACCO)- Trades at only 6X earnings and has a beta of 3.8. Any company with a beta over one is considered to be a bigger mover. The technicals look promising as well since ACCO is on the 200 day moving average (black line). This makes me enthusiastic about the stock. So, I would buy call options. To pay for this call, you might then sell a put to get in at 7 since, long-term, that seems to be support. Don’t just sell puts to pay for calls with most stocks. Only sell puts when you think a bottom has truly been put in place.

Aecom Technology (ACM)- The company has a 1.1 beta- not traditionally big mover. It depends on your time frame but, with the big move up recently, one might want to protect his/her’s profits. Unless a catalyst is driving this higher, then you should be prudent by selling covered calls. You get paid to take a profit essentially. If you are more bullish, however, just let the stock run.

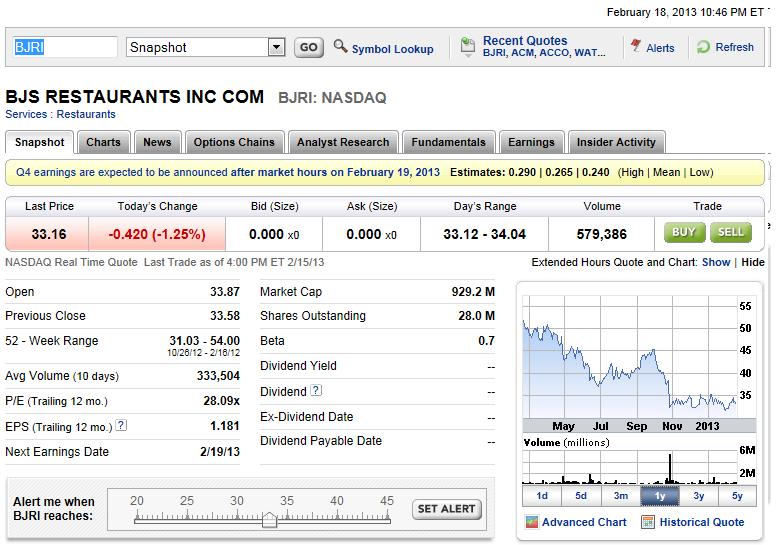

BJ’s Restaurants (BJRI)- The stock has been out of favor by wall street lately but, some positive developments are taking place. The stock has just passed above the 20 and the 50. If these levels hold, the stock is good for a bounce. After all, it has had a pattern of oversold bounces in the past. I would wait until this uptrend begins before getting too aggressive and buying calls. If you think the bottom has been put in, however, explore selling puts.

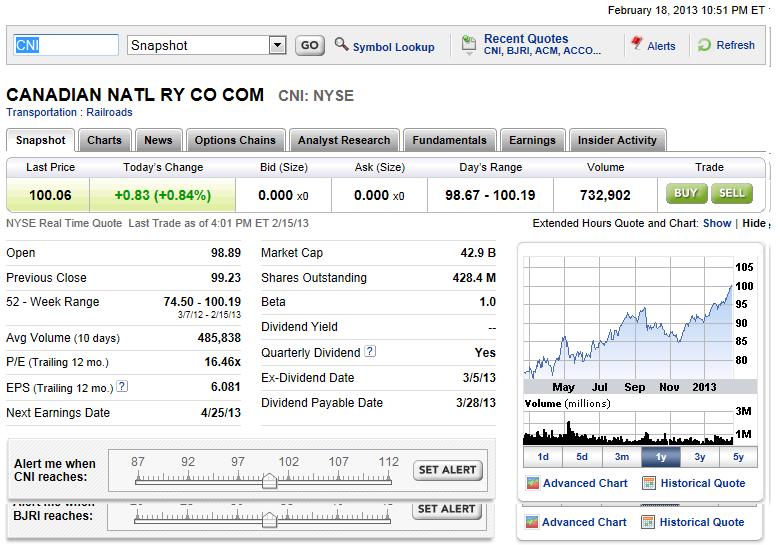

Can. Nat RR (CNI)- Railroads have been on fire all year, but a new leg higher has begun for CNI’s current uptrend. Waiting for a pull back to the 20 would be a great time to buy calls on this one.

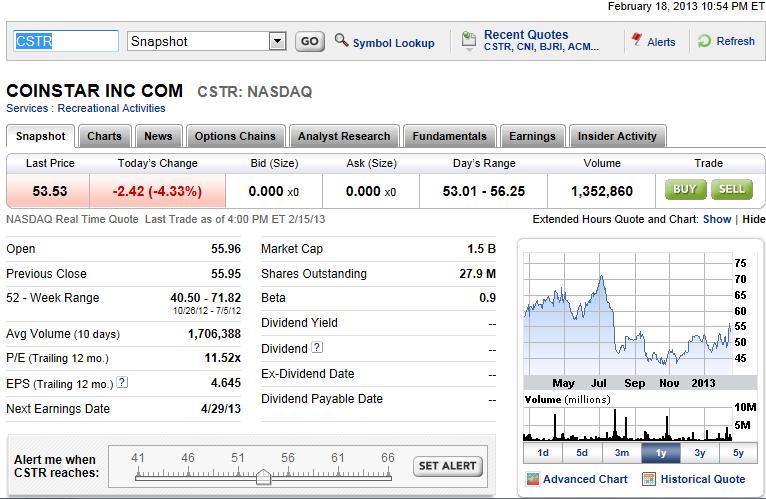

Coinstar (CSTR)- Ok, Netflix has been on a tear. Obviously money managers feel CSTR will participate in the frenzy judging by the large move CSTR just made. We had a strong break out above the 200 day moving average- and the 4% pullback back to the 200 is an ideal buying opportunity. If you feel there will still be a period of consolidation, hold the stock and do nothing.

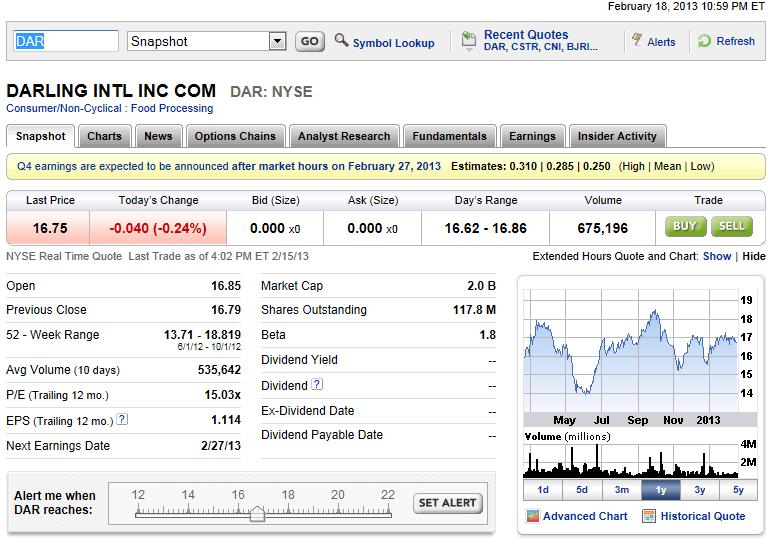

Datling INTI (DAR)- This stock has been in a period of consolidation and shows mixed signals when using technicals. Would just hold this stock, with 16 and the 200 day moving average being support, and wait for clarity.

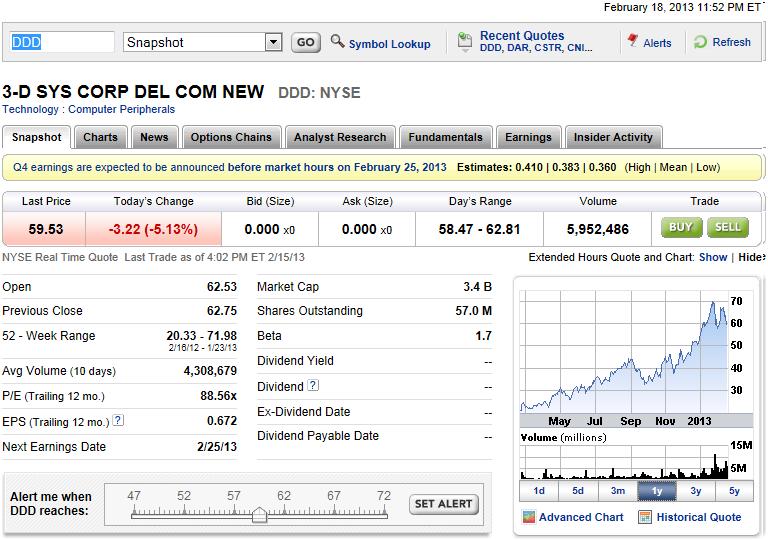

3 D Systems (DDD)- A fascinating space to be involved in. The stock has been digesting its previous move up and is churning around the 50. You would have wanted to sell calls after that huge run-up, typically. However, these companies could be the wave of the future. You could end up putting a lid on your gains going for the quick buck when you sell the calls; this company could definitely run away from you and surge higher. Best to just go long-term on this one.

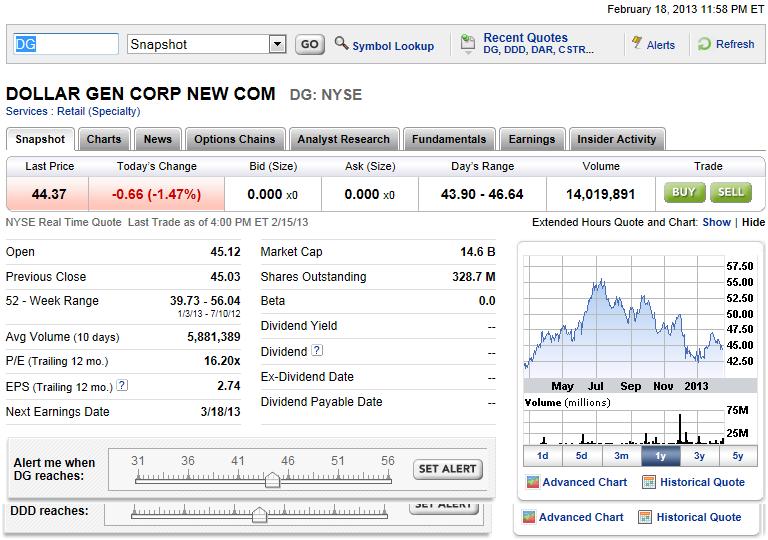

Dollar General (DG)- Being that DG is defensive in nature as people tend to shop more frequently at discount retailers during tough times, it is has been rotated out of by money managers and cyclicals were then rotated into. Buy puts on this one if you feel the down trend will continue. However, If you feel most of the downside is out, simply hold the stock. Also, if you still wanted to buy a put option, you could, and this would then define your risk with that purchase. This would basically stop the bleeding on your underlying shares and minimize your downside.

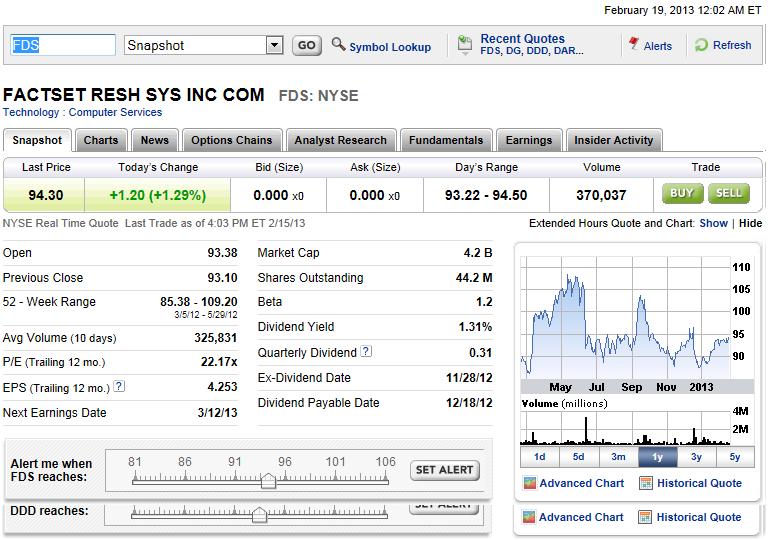

Factset Research Syst (FDS)- This is an interesting company. It flies under the radar and is basically a bet on people moving back into equities as well as a way to play the red hot financials sector. So, these catalysts could drive this stock higher from 94, even though it is at current resistance against the 200. Also notice how 90 is long-term support. The combination of these factors make me inclined to sell puts at 90. However, don’t use options on this one unless you really believe the stock will keep 90 as the bottom. Selling puts involves unlimited downside risk to your underlying shares.

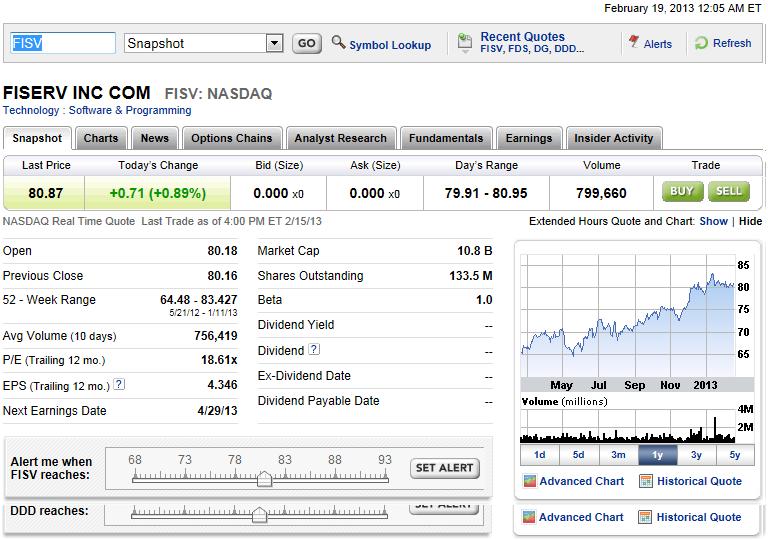

Fiserv Inc (FISV)- This is another play on the hot financials theme. If banks are doing well, they will probably need more transaction processing systems, and tools of that nature from FISV. So there is a good catalyst. However, even though this stock is on the 50, a good support area, the 20 day (short term moving average) is trying to cross below the 50. The move higher needs to happen quickly for FISV or the stock could fail technical support and follow the 20 day moving average down, turning the 50 day into resistance. These events have yet to take place, and FISV could definitely just use the 50 as a spring board to move higher. So, don’t buy calls on this yet, wait for clarity on the 50 day.

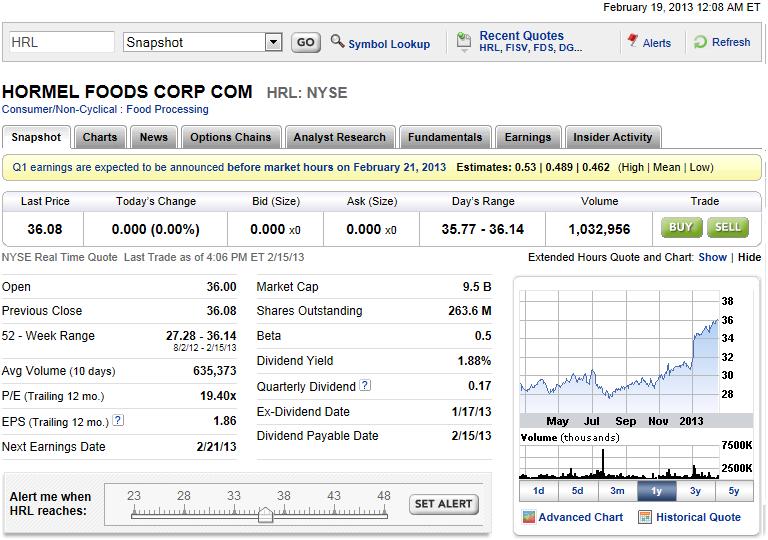

Hormel (HRL)- This thing is on the move to all-time highs despite it being only a .5 beta and a consumer staple name (traditionally slower movers). But the move does not appear to be over. If you want to take the gain here, sell covered calls HRL. If you think the move can continue, just hold the stock. I would not buy calls on this with it being only a .5 beta name. There is just not enough volatility for buying options. (Selling is another story).

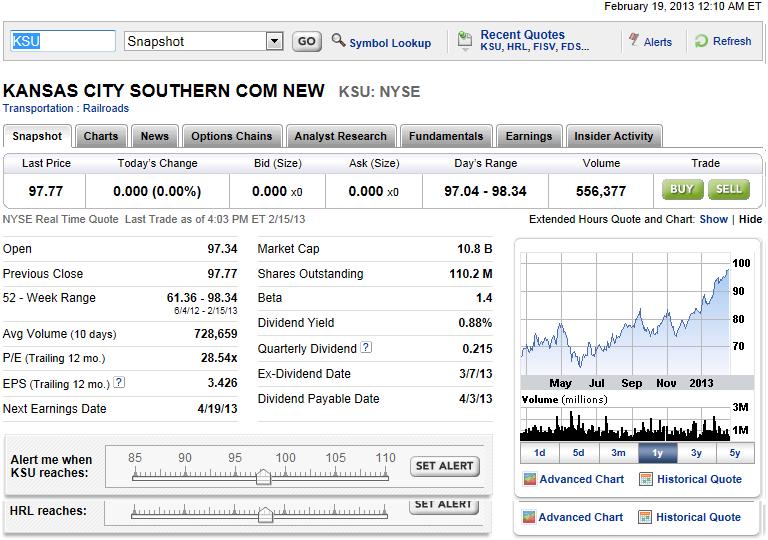

Kansas City Southern (KSU)- As with CNI, this railroad play is doing great for the portfolio. It has had a pretty big run recently, so selling calls is an option. However, I don’t think this one is done running up. I would hold and let it ride.

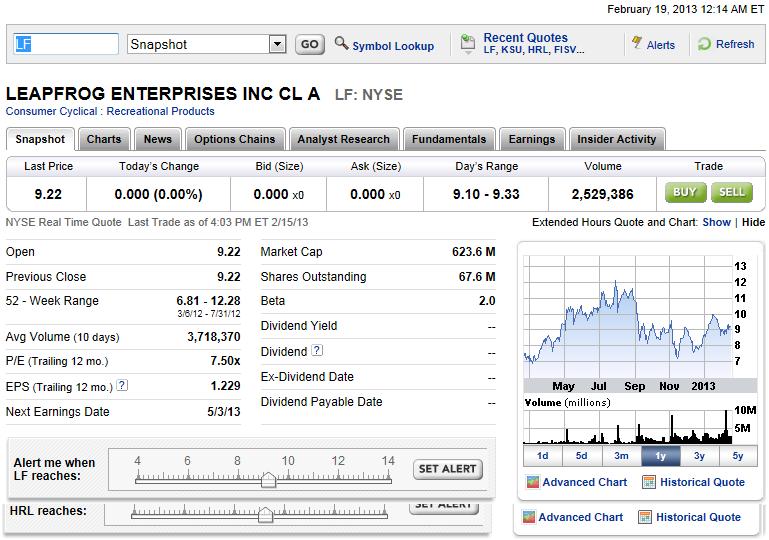

Leapfrog Enterprises (LF)- Ah, a good straddle candidate. This child learning company is in a tight range. With it being cheap (only 7X earnings) and it having a 2.0 beta- this one is capable of a big move out of this range. If you feel the stock is on the verge of a move, (the direction you are unsure of) employ a straddle. This is where you would buy a call as well as a put. Which ever direction it moves, as long as it is a substantial one, you will make money. As the stock picks a direction, either the call or put will appreciate in price while the other will expire worthless.

Materion Corp (MTRN)- I used to own this while it was Brush Engineered and featured a piece on this company a while back. Its long term support was definitely re-affirmed at 20 and was a text book buy on the 50, technically speaking. This one was a thing of beauty; it went from 20-30 in a short period of time, a 50% plus move. Sell calls to protect your gains. Me personally, I would just put a good, old-fashioned stop-loss on below 27.50 and let it ride. I see 35.00 or 40 as being the next stop for MTRN (MTRN’s old highs).

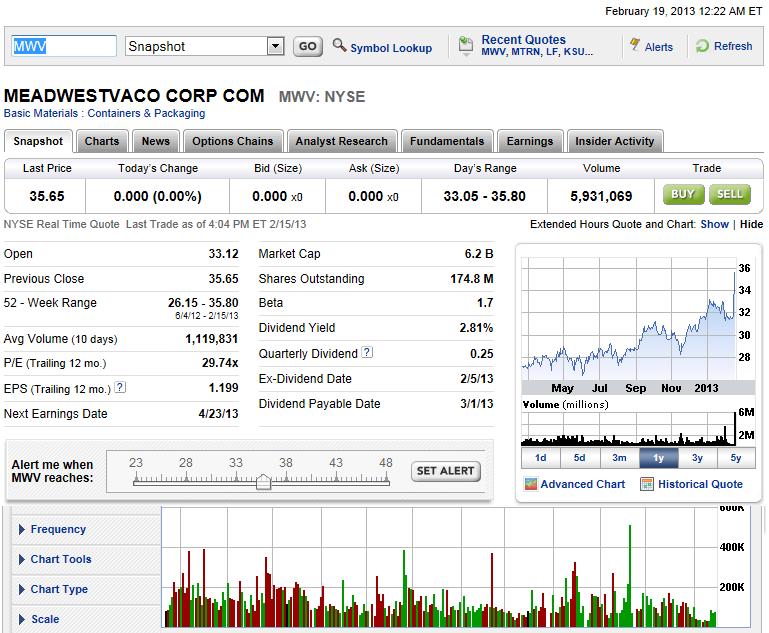

Meadwestvaco (MWV)- Oh my gosh sell calls here. You would get paid a pretty penny on top of your gain since volatility expanded so quickly for MWV’s options. However, this one is not done going higher either. Since it is as at all-time highs, with no resistance in the way, I see blue skies ahead for MWV. Don’t cap your gains by taking the quick buck and selling calls unless you feel the stock will consolidate for a period of time and digest that run.

RPC (RES)- This energy play is in a nice uptrend. If faced 2011 resistance at 17.00 and as pulled back as a result. 17.00 would have been a perfectly reasonable time to sell calls as resistance and profit taking would weigh on the stock short-term. Wait for RES to surpass 17 before taking any further action.

Transocean (RIG)- This was once a core holding of mine and I sold it for a nice gain. However, I did not foresee that power move it just made. I missed that move! It looks a bit toppy here, so selling calls would not be a bad idea at this point.

Ross Stores (ROST)- You could not go wrong with this discount retailer in 2012. Like with Dollar General, it has been rotated out of by money managers. It is at resistance of the 200 day moving average so buying puts here would not be a bad option. However, this, along with Marshalls (TJX), is a quality name. Don’t bet against them. So they are out of favor right now, big deal. That is the point of diversification and going long-term. I would just hold the stock.

Triumph Group (TGI)- Aerospace and defense should be a strong theme in 2013. TGI is reflecting that strength. Despite Boeing’s weakness from its manufacturing delays, TGI continues to work higher. Because it is only a 1.1 beta name, I would not use options on this one. I would just be a buyer of the stock at 70.00, which is roughly the 20 day moving average.

Varian Medical (VAR)- The 20 is crossing below the 50 on this one and looks a bit worrisome- short- term. So buy puts right? Well, 70 appears to be a base of support after its big run-up in November. I would wait to see if this holds. If anything, the stock looks like it could continue to churn sideways for a period of time. Sideways to down seems more likely to be the trend than up for VAR. So, selling calls here might be a viable option. The premiums might not be worth it, however, since it is only a 1.1 beta name. You would have to check.

Waters Corp (WAT)- Good uptrend and is on the 20. I do not know the catalysts for water at this point except that it is an endangered resource. So, the stock looks good to buy here but not the option. It is only a 1 beta and, while it has had a nice run since November, it is not a fast enough mover to use options with. The calls, which you would typically buy on a pullback to the 20, might expire worthless before the stock makes a substantial enough move- due to time decay.

Aqua America (WTR)- Here is a utility play. You don’t want to use options with utilities since historical volatility is usually low. It has had a nice run-up though, indeed. I would just continue to hold this stock along with WAT.

So, as one can see, options are a valuable tool when investing in stocks. However, most scenarios need a perfect storm of events to warrant using options. They can be a great way to maximize a stock position that you own but, more times than not, could be a detriment to the position. I have engaged in a lot of trial and error to learn about options. So, take it from me, unless you don’t mind sitting in front of a computer screen and trading all day, every day. Cheers!