If the correction is over, buy stocks that will benefit from an expanding economy and rising interest rates (financials, industrials, & other various cyclical companies). Aero-space/defense stocks (cyclicals) have been on a tear lately from lower fuel costs and restructuring measures (which have completely turned around the airliners).

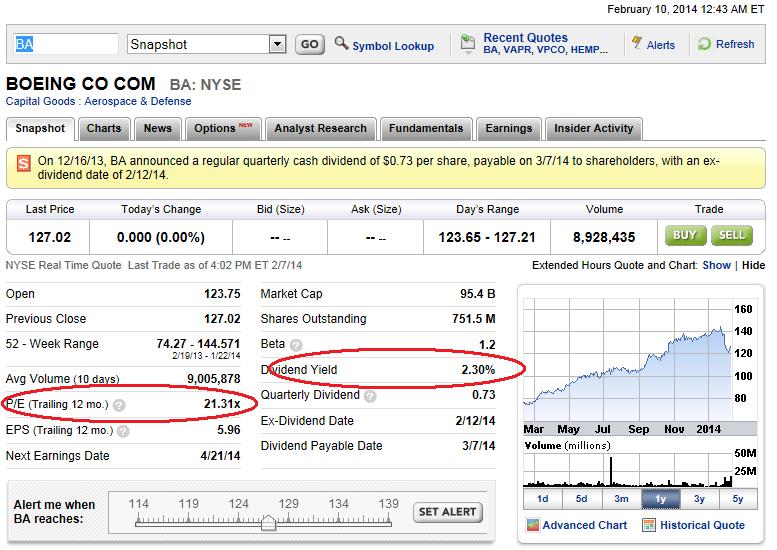

A rising tide raises all ships, so it is no wonder that all of the aerospace names have done well this year. However, you always want to go with a best of breed company when picking through the rubble after a correction. At only 21X earnings, more than a 2% dividend, and more than 10% off its highs, Boeing (BA) is your best risk/reward play.

After healthy consolidation, Boeing ($BA) is ready to move. Risk/ reward is good here, putting my stop loss in at 19.00 and looking to exit at 35.00. Buying at 25.00 and 20.00 in $5,000 lots.

Plus, it is on technical support of the 200 day moving average.