The stock market today closed up fractionally, a healthy sign after big moves. We are beginning to wonder if the bull market is running away from us as we are waiting on pullbacks for better entry points and not getting them.

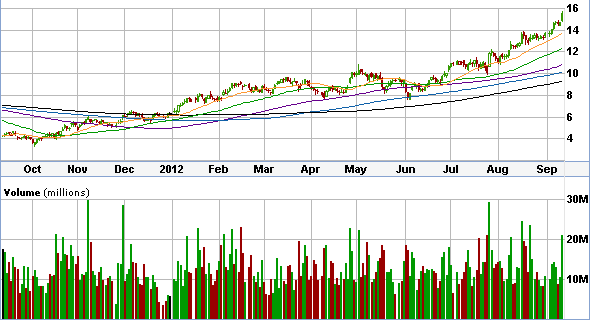

To increase our leverage and maximize cash, we bought October 20 calls on PHM and sold the stock. Look at the chart (below). It is on a tear and does not want to come down (see analysis: Pulte Homes explained). So we sold out of our long position for a 5% percent gain and switched into the calls with the house money (300 shares, nothing too risky).

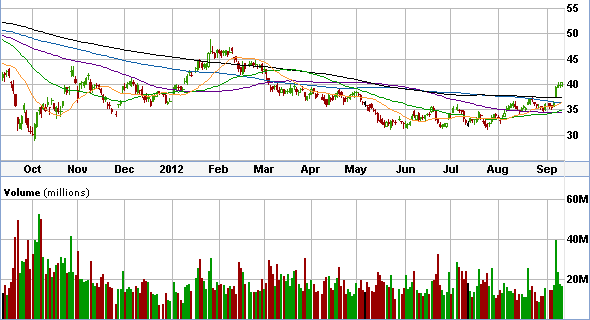

We also added to FCX and GE today. Freeport McMoran (Copper & Gold QE 3 Plays-chart below), is ripping higher as well. We want to add on the pullback but, as stated above, we are not getting it. So, we decided that we will add more to the portfolio as we write this update, and double down if it retreats to the 200- on a pullback (black line below). We figure we will stop out of 3/4th’s of FCX if it breaks the 200. But until then, waiting for FCX to work higher is not so painful when you are receiving a 3% dividend in the process.

Here is a chart below as always of the overall market (S&P 500). It has broken to new 3 year highs on the idea that if the market ever falls we will get the “Bernacke-Draghi back-stop” which helps shield stocks. More importantly, with this confidence corporations and consumers are now gaining, business can begin booming again like in 2008. Tax reforms will be the next critical step for the economy because it will dictate where jobs go. If the elections keep causing gridlock like they are now the markets will work higher, historically speaking of course.