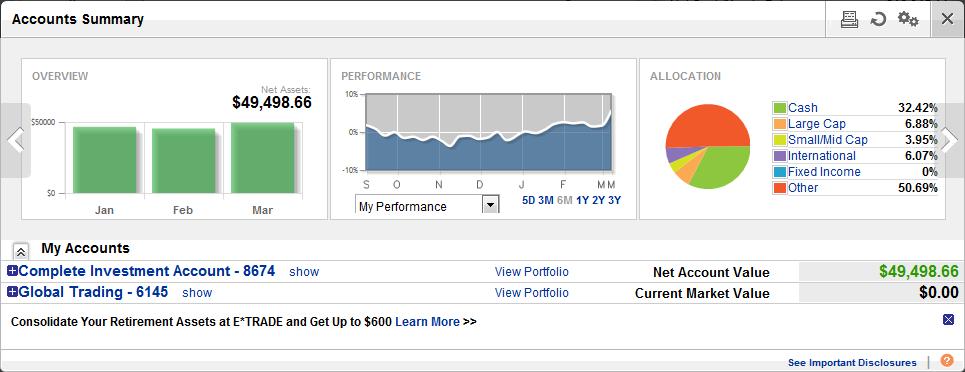

Here is what pundits are saying: This is a Fed induced rally, it isn’t real. This is a catch-22; damned if we do, damned if we don’t (use monetary easing that is.) Ben Bernacke said “he would stop using monetary easing if the economy could sustain itself on its own or if we could reach 6.5% unemployment.” Well, the bears think the end of qe3 will spiral the economy out of control but the bulls (and I) think no easing is actually a positive sign because, after all, we would be self-sufficient again. Here is a chart below of the S&P 500 year-to-date. I think it speaks for itself.