When formulating an investment thesis on picking stocks, the first place to look is at the S&P 500. If this index is doing well, then trading is pretty much a no brainer. You could pick just about any stock and win. As of now, the S&P 500 is not telling us anything. The trend is up and it finished above the 20 today, but that’s not enough. Things are feeling “toppy”.

If you see what I’m seeing, it is going to take a lot more than S&P trend reading to figure out this market’s riddle. For one, the transports could be rolling over- not sure yet. Union Pacific (UNP), a bellwether railroad name, broke the 50 day moving average and could be rolling over. We’ll see. We got a nice, perhaps meaningful, bounce in UNP today. This idea is known as the “Dow Jones Theory”. If transports are strong, so is the economy.

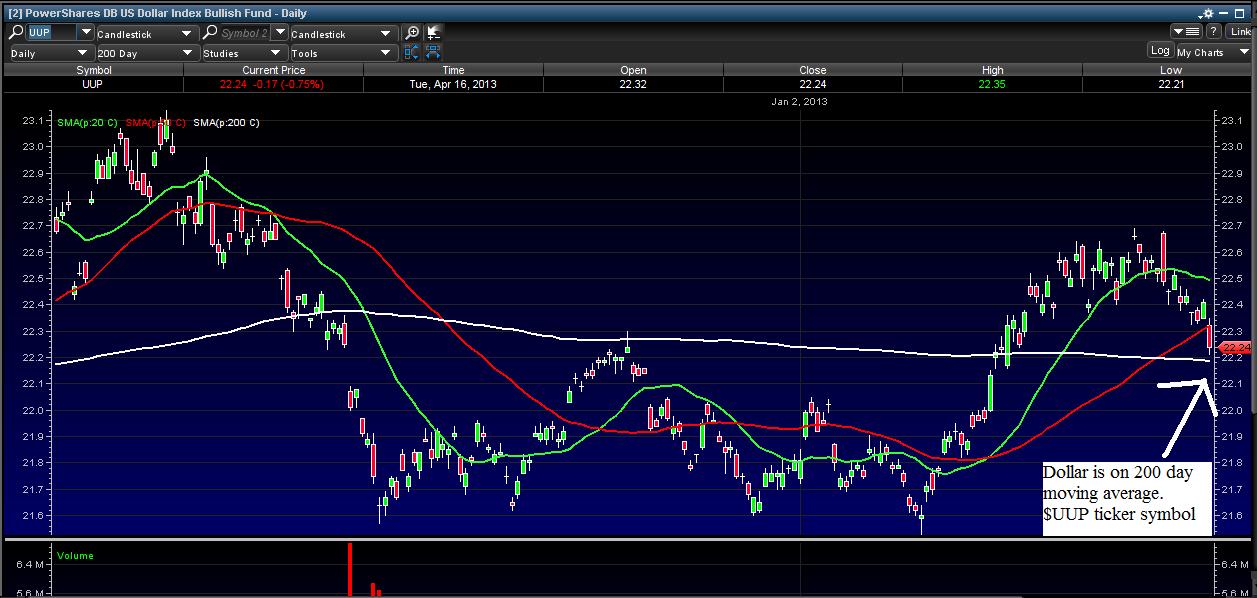

Another indicator to follow is the Dollar/Yen trade. If Japan keeps up their aggressive stimulus policy, the yen will continue to weaken against the dollar. A strong dollar is good for the U.S. in the long-run, but for now, it means corporations will make less money. As with the transports, the dollar is on strong technical support (the 200 day moving average). These two indicators alone could be pivotal for markets going forward in April.

The last thing I will point out for today is the macro environment. China has slowed but still sees robust growth with 7.7% GDP. Yes, it could slow further, but for the first time in a while, U.S. equities are the place to be. Our economy is recovering and U.S. corportations have the best balance sheets in the world. (No updates to the portfolio today. Follow me on twitter for the latest.)