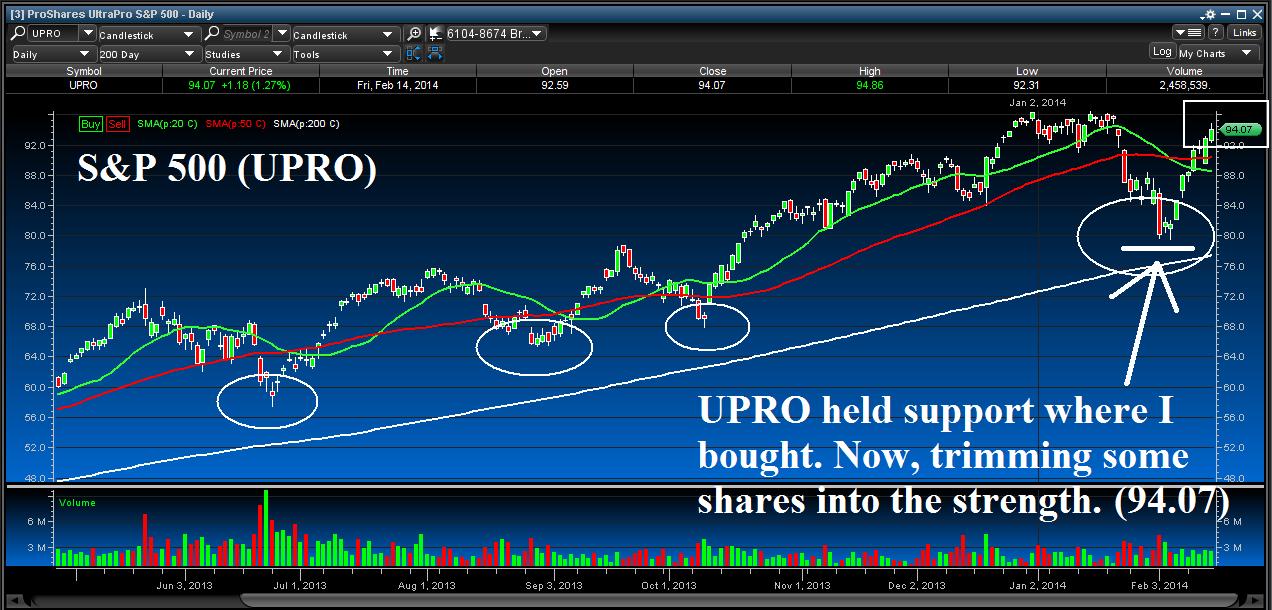

Now that’s what I call a bounce. After correcting nearly 7% from the start of the year, the S&P 500 came back with a vengeance. Buying into the dip (“Nibbling into The Correction”) definitely paid off as the portfolio is now up 4% for the year while the S&P is still down about a percent.

Now that’s what I call a bounce. After correcting nearly 7% from the start of the year, the S&P 500 came back with a vengeance. Buying into the dip (“Nibbling into The Correction”) definitely paid off as the portfolio is now up 4% for the year while the S&P is still down about a percent.

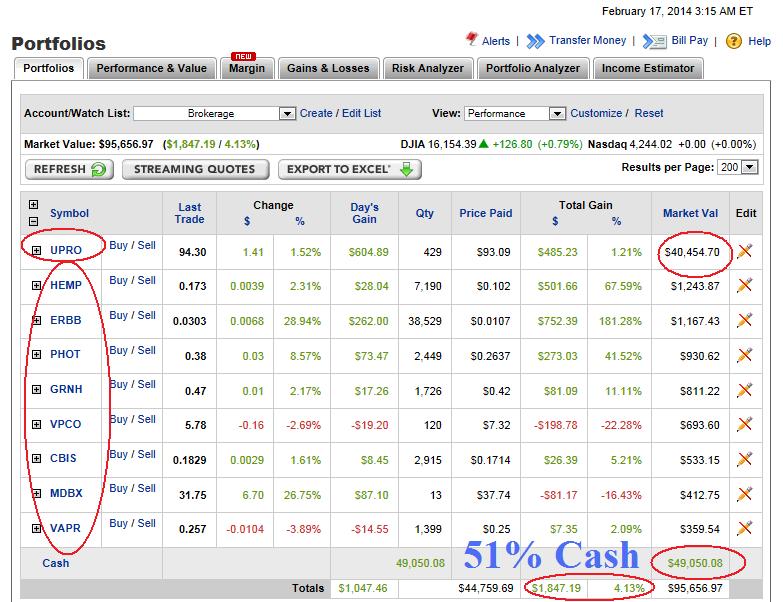

The marijuana stocks have also helped boost the bottom line; all were up over 100% at one point. However, there is not enough money in those to really affect the portfolio (only about 5K total). The real focus will continue to be on buying the S&P 500 (UPRO).

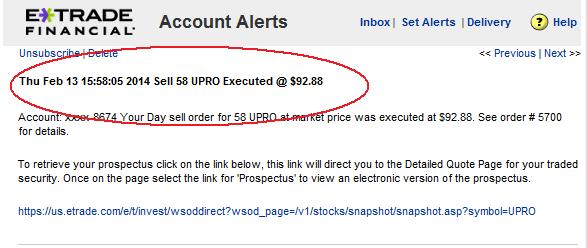

I trimmed 5K out of UPRO after the huge bounce back from the lows to manage downside risk and stay disciplined. Going forward, I will just sit back and enjoy the ride with 40K in UPRO, definitely enough to make a dent. If the market decides to fall for whatever reason, I will buy the dips at select moments with my unusually high cash position (51%) and issue alerts. Regards.

Nicely done!