This is one determined bull market. We continue to climb the wall of worry, time and time again. Not even fears over Russia can stop this juggernaut. I have not been writing much lately because this is just the time to sit back and let your gains ride. If it aint broke don’t fix it, right?

However, I have been doing a lot of coverage on the cannabis stocks (in case you’ve noticed). You need to pay attention to my updates on these because they have made me a small fortune this year. Last week alone, we got a 100% gain in both Tranzbyte (ERBB) and Growlife (PHOT). You can find out more about those under the “Stock Ideas” section.

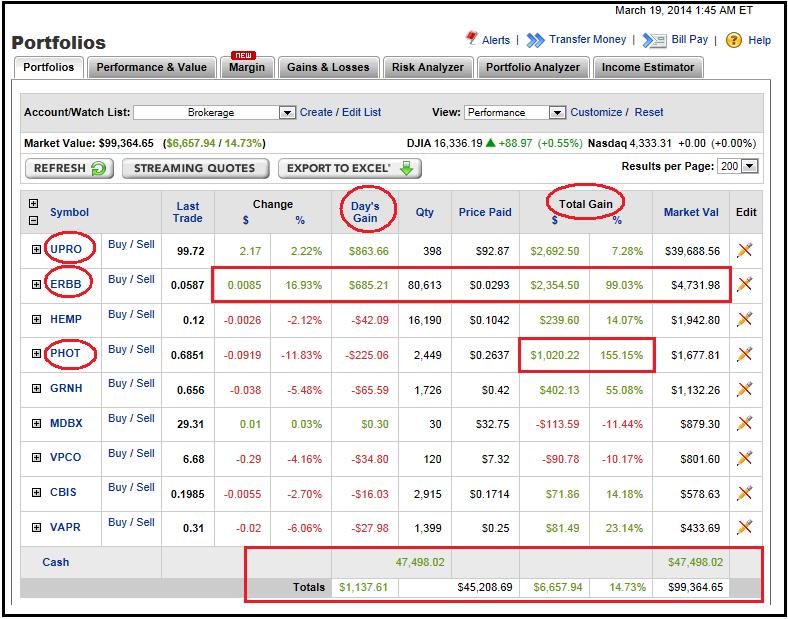

I just wanted to briefly mention the impacts they have had on the portfolio recently. Yes, most of these cannabis stocks I own have doubled, tripled, and one even got a quintuple. But, the diversification and purchasing power they have provided has been the far bigger story.

On down days, they have been bucking the trend and going up (people don’t stop smoking during a recession 😉 ) and they give me bigger movements in my portfolio using less cash (leverage). This allows me to preserve more cash to fund my favorite S&P 500 position (UPRO) for when it goes down with the overall market.

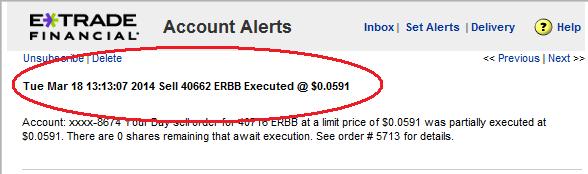

This is why I am up in UPRO 7% YTD. Because of all the spare cash the marijuana stocks have allowed me to raise, I can buy UPRO freely on any dip. I have been continuously trimming ERBB (above), PHOT, and UPRO into the strength in order keep those positions balanced and manage my downside risk.

So for the moment, the strategy will continue to remain the same: Sit back, let your stocks work for you in this bull market. Still buy on the dips (weakness) and rebalance into the rips (strength). Regards.