S&P 500 (UPRO ETF)- Holding the 50% retracement level. If this level holds, it will be bullish for stocks. Surpassing the 38% level last week was huge. Now lets see if the market and our portfolio will turn the corner on this positive development.

S&P 500- On the 50 day and 100 day moving average. This level, along with the 50% retracement level, must hold. However, if they break, the 20 and 200 day moving averages are not far underneath. So, this is still bullish for stocks as the trend should stay intact. If these moving averages fail along with the Fibonacci’s above- look out below.

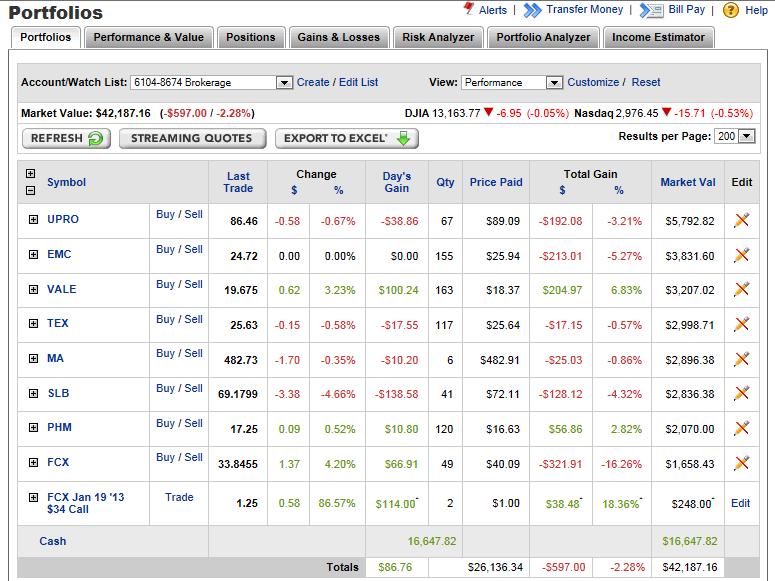

Here is an update of my portfolio. Understand that we took gains last week to raise cash for our new names like Vale, Upro, SLB, etc and the market has had profit taking over the last few days so, this is actually a healthy development for the portfolio and a much needed breather for stocks. Looking to add to these names on further weakness but first we must see if the technical levels, noted above, hold before I make a decision.

I will close out our FCX call (up 88% today) as I write this. It would be nice to hold onto the call because I believe there is more upside left in FCX. However, we were just playing the bounce. No need to get greedy. If there is more upside in FCX our underlying shares will still benefit. We will revisit options on FCX again at 32.

SLB also took a hit today on “weak 4q earnings anticipation.” It has rallied off of the lows, which is a good sign, and the long term trend is still intact. However, it did break all of its support today so, while I and others believe this is a buying opportunity, I will still let the dust settle before adding as the chart technicals just cannot be ignored. We are also more overweight in stocks now; don’t want to get wreckless. More to follow.