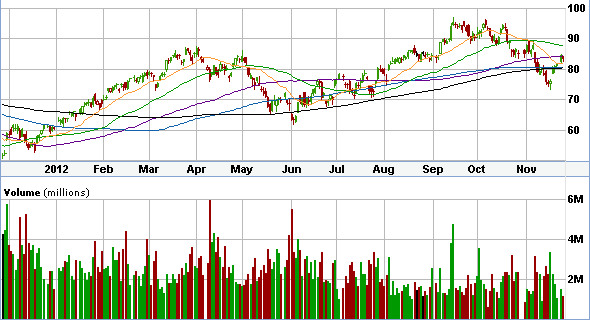

Here is the S&P 500 with Fibonnaci retracements in place. Today, we broke the 20 day (yellow line) and 38% retracement level (purple rectangle line), bounced and found support on the 200 (red line), and have now hammerred on the 20 again. (See hammer-candlesticks). We mentioned that we would be in a narrow trading range and will break out if it pending fiscal cliff news. Today, as you can see, we got bad news out of Congress in the a.m. about the fiscal resolution but, Boehner (republican) came out later saying he was pleased with the talks and the market snapped back. 11-28-2012

The S&P 500 ended up rallying into the close on positive fiscal news announcements. We tagged the 50% retracement line (exactly) and tagged the 200 (red line) at the bottom, briefly; a wild day to say in the least. We opened on the 20 day (yellow line) and closed exactly below the 150 day (white line). Still in a tight range.

We added to EMC today on the pullback at the 20 day moving average. We would have bought calls on SPY or UPRO but decided to spread our risk out a bit better by adding to our core tech holding EMC, which also displays a similar chart as the S&P 500 (Both are on the 20). If the market falls, so will emc, however, it will be less of a blow to the portfolio than if we bought a triple S&P 500 (UPRO) or calls on the SPY. Regards.

As we said last week, Monday will have resistance at the 100 (purple line) but not for too long, because the 20 day support and 38% retracement level is just below. Expect a narrow trading range to develop tomorrow, with an eventual break to the upside or downside. There is know way of knowing of course depending on what the headlines for tomorrow will be. We added to UPRO at the end of the bell today for a quick trade with a stop loss below the 20 (orange line), just in case we go higher tomorrow. Good risk/reward. 11-27-2012