I have always hated these high yielding dividend plays because I always got burned. I just didn’t have the patience or the trust needed for a 15% dividend yielder. I mean after all, one has to question a 15% dividend. Also, you have to stay in it for the long haul if you want that return (1 year). Are you really willing to tie up precious cash (at least enough to make a difference for 15% in a year) for such a risky, boring asset?

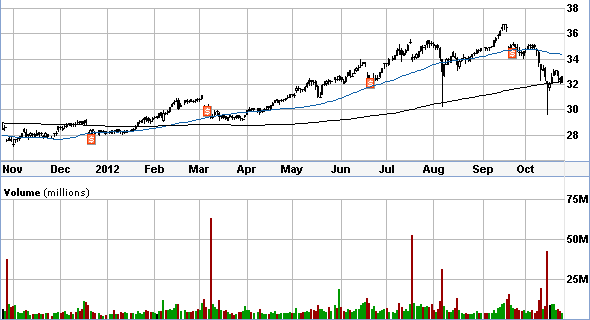

AGNC 1 Year. On the 200 (Black Line). Red points on the chart represents dividend distributions…and usually opportunities to get in.

The question is, what do they do, is their dividend sustainable, and what will interest rates and market conditions be for the next year? The company ” is a real estate investment trust (REIT). The Company earns income primarily from investing on a leveraged basis in agency mortgage-backed securities. These investments consist of residential mortgage pass-through securities and collateralized mortgage obligations (CMOs) for which the principal and interest payments are guaranteed by government-sponsored entities, such as the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac), or by a United States Government agency, such as the Government National Mortgage Association (Ginnie Mae) (collectively, GSEs). It may also invest in agency debenture securities issued by Freddie Mac, Fannie Mae or the Federal Home Loan Bank (FHLB). The Company is managed by American Capital AGNC Management, LLC, which is an affiliate of American Capital, Ltd.

Also, by all indications, the dividend is safe and interest rates will be low until at least 2014. Is AGNC a good time to buy?