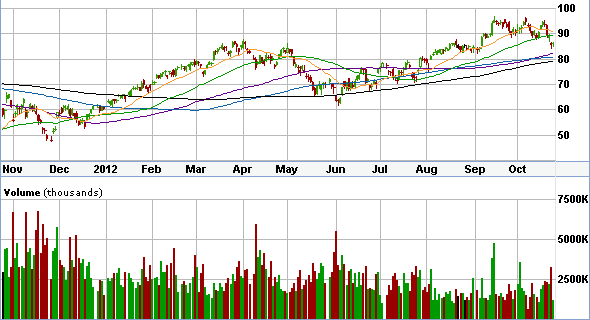

We have made changes to the portfolio to take advantage of long-term opportunities. We added Caterpillar (CAT) to bolster our industrial/ agriculture exposure. We also liked Cat’s recent earnings call as it was tepid on global growth, but the company is discounted enough here, in our opinion. The overall market (S&P 500) is below. How this goes, others will go.

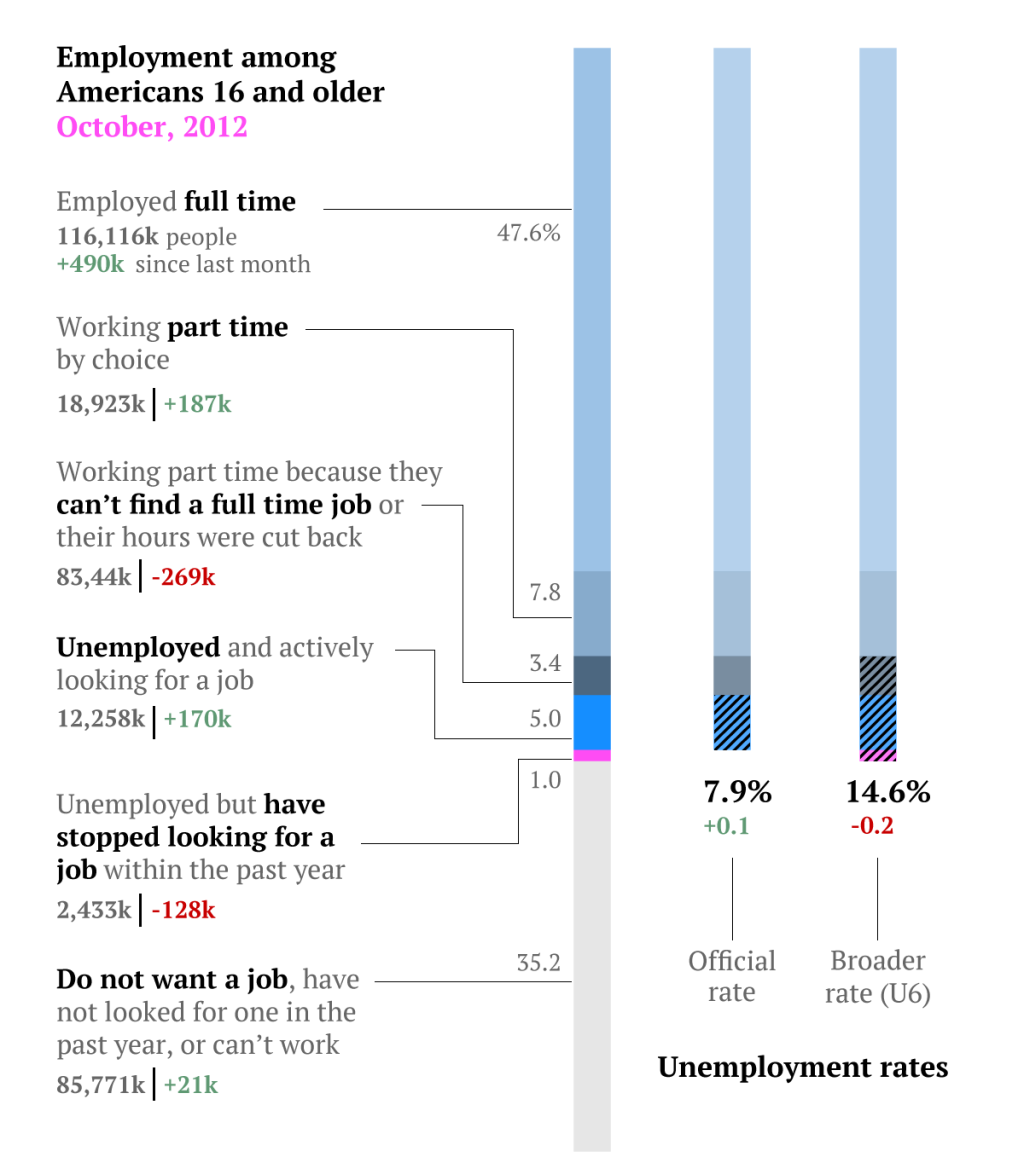

Here are some current unemployment numbers:

We added to EMC on the pullback after another strong earnings call. Yes, the data storage maker missed on earnings due to weak macro concerns. However, these issues were not EMC related, and the company’s growth story remains firmly intact. We view the pullback as a buying opportunity and $24 looks to be a significant support area.

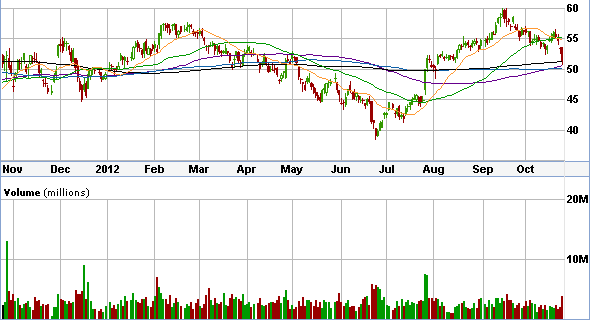

We sold out of ETP for a small loss to raise cash for our other holdings. These are opportunistic times for some stocks if you are a long-term investor. We now have 9 stocks in the portfolio and are looking to add one more to the mix after earnings season is out of the way and companies show their cards. We are watching Cameron Corporation closely, a best of breed in the energy space. Here is its chart below- it has reached the 200.