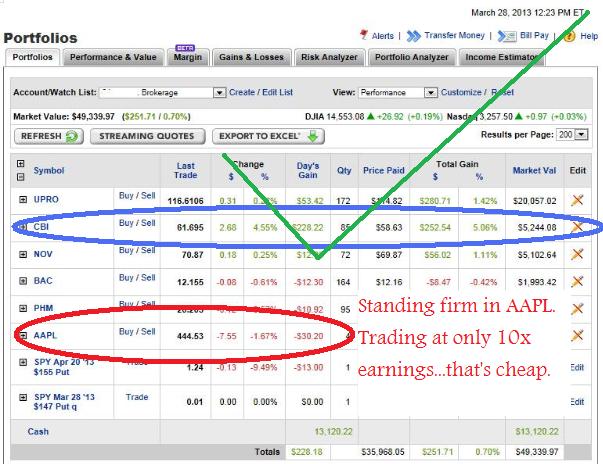

Bought back an old favorite in Chicago Bridge & Iron. I don’t feel good about buying the market at these extended levels because the Cyprus debacle going on right now could derail the S&P 500. There is a dilemma I’m facing, however. I am in too much cash, like many investors at the moment, and need to deploy it because I can’t get a return for it anywhere else (saving accounts-no, bonds- no. Not with interest rates these low). I need more of a reason to sell or stay in cash than “Cyprus”. They only account for .2% of E.U. gdp anyway. Plus, by buying CBI stock, I round out the portfolio with a solid cyclical. If the market does decide to sell-off tomorrow or next week, the stop-loss has gone in below on CBI at the 20 day moving average- downside 2%, upside 10%. (See left: Burj Al Arab, Dubai- built by CBI)

Bought back an old favorite in Chicago Bridge & Iron. I don’t feel good about buying the market at these extended levels because the Cyprus debacle going on right now could derail the S&P 500. There is a dilemma I’m facing, however. I am in too much cash, like many investors at the moment, and need to deploy it because I can’t get a return for it anywhere else (saving accounts-no, bonds- no. Not with interest rates these low). I need more of a reason to sell or stay in cash than “Cyprus”. They only account for .2% of E.U. gdp anyway. Plus, by buying CBI stock, I round out the portfolio with a solid cyclical. If the market does decide to sell-off tomorrow or next week, the stop-loss has gone in below on CBI at the 20 day moving average- downside 2%, upside 10%. (See left: Burj Al Arab, Dubai- built by CBI)