Stocks are finishing the year strong. Can they continue this current rally? Fund managers are chasing performance into the end of the year as well as bullish retail investors.

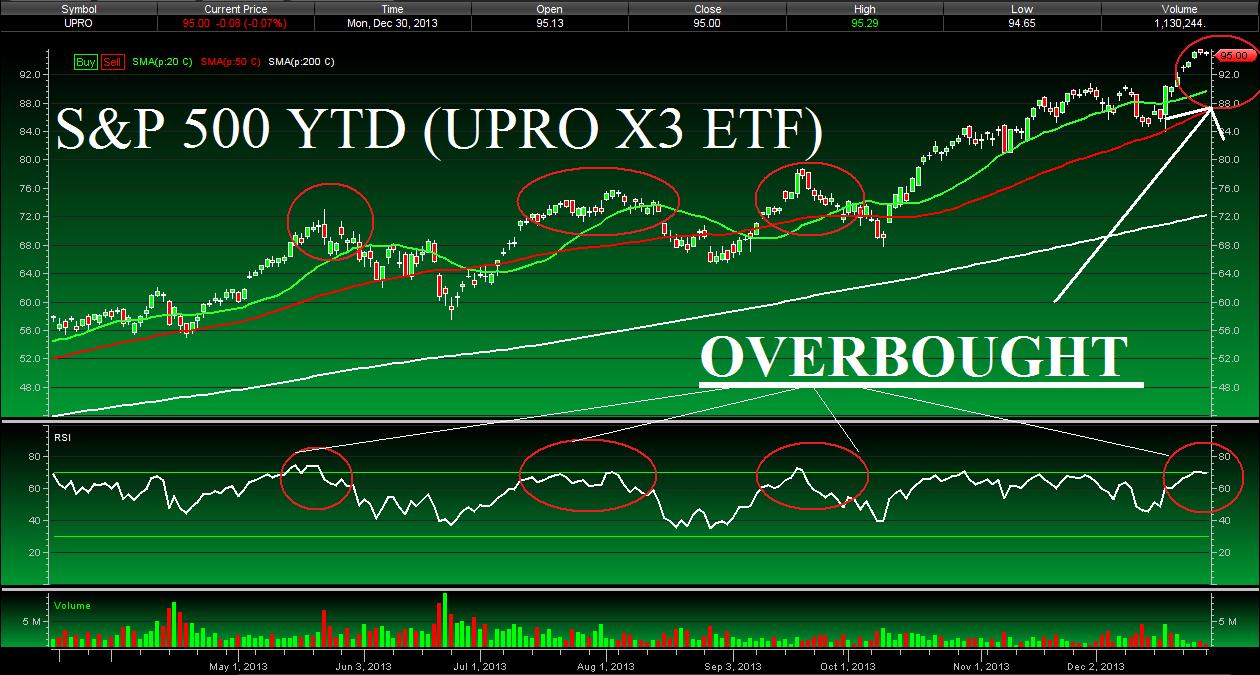

Personally, I believe that 2014 is poised to be another good one. 75% of the time, good years follow great years in the stock market. Plus, most of the uncertainty surrounding tapering and Washington is now removed so investors can begin focusing on fundamentals again. Short-term though, the chart of the S&P 500 (see analysis above) shows otherwise, which is why I am positioned in so much cash at the moment.

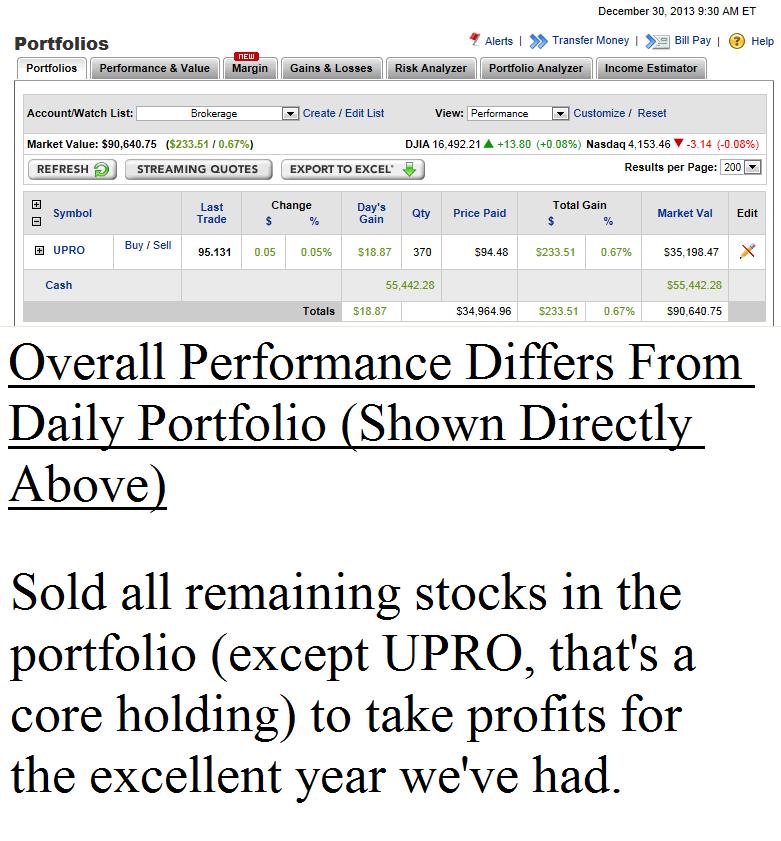

Portfolio Strategy: Stay the course. Invested in high-quality beta (UPRO- S&P 500 X3 ETF) if we go higher but in over 60% cash if we decide to fall; in which case I will be licking my chops to buy more UPRO. Buying every 3% dip on the way down. Regards.