I have always welcomed intervention from the Fed. But, as much as I would like for them to stick around, (to make sure we don’t repeat the mistakes of Japan and Britain, in particular) the Fed insists that the U.S. economy is recovering at a healthy rate and is therefore backing away (tapering) from their 85 billion a month bond-buying program. I take this as positive sign but the markets might not as debates over the timing of the tapering will be front and center next, possibly leading to increased volatility in the near future. So, I have made adjustments accordingly:

I have always welcomed intervention from the Fed. But, as much as I would like for them to stick around, (to make sure we don’t repeat the mistakes of Japan and Britain, in particular) the Fed insists that the U.S. economy is recovering at a healthy rate and is therefore backing away (tapering) from their 85 billion a month bond-buying program. I take this as positive sign but the markets might not as debates over the timing of the tapering will be front and center next, possibly leading to increased volatility in the near future. So, I have made adjustments accordingly:

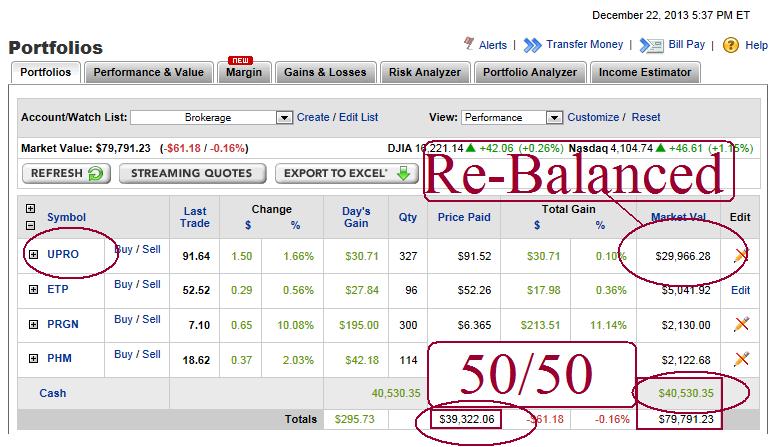

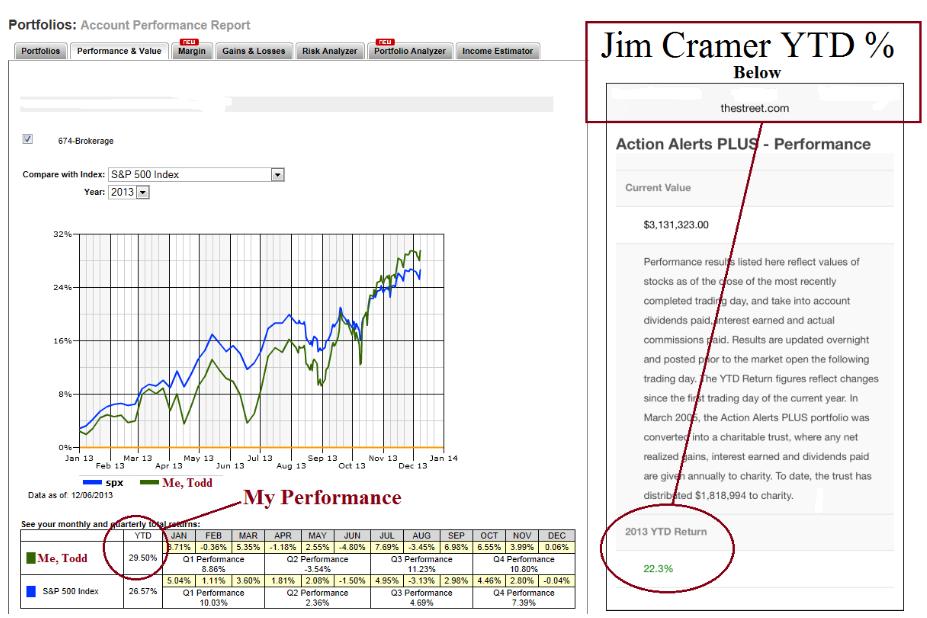

Portfolio Strategy Changes: None. Other than trimming UPRO (The S&P 500 index X3 ETF) into the strength and adding to it on weaknesses, the strategy is to stay the course. I will continue to buy the dips with our heavy cash position and re-balance the portfolio after gainful moves, keeping with our 50% cash to 50%equities stance. Here is a chart of the S&P 500 below.