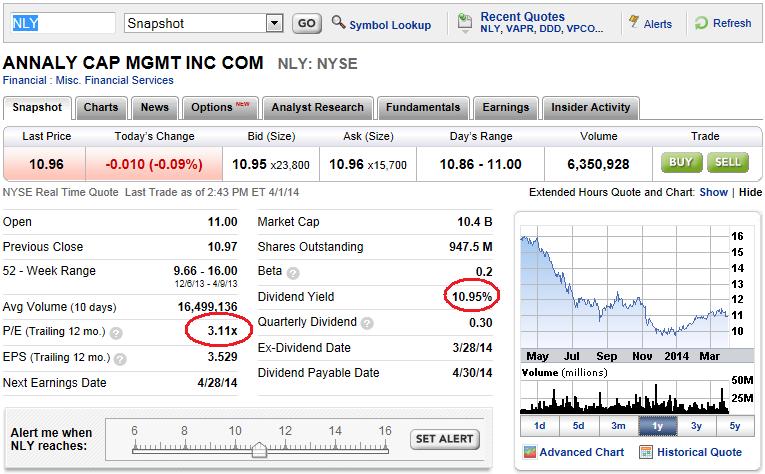

Utilities and dividend plays have been getting killed as of late due to the fed’s tapering program. However, I think there is some good value left in dividend plays, it just depends on where you look. Annaly Capital was a stock I featured a long time ago on this site and is dirt cheap now (trading at 3x earnings) but, since 2010, anything interest rate related has been taken to the woodshed.

Utilities and dividend plays have been getting killed as of late due to the fed’s tapering program. However, I think there is some good value left in dividend plays, it just depends on where you look. Annaly Capital was a stock I featured a long time ago on this site and is dirt cheap now (trading at 3x earnings) but, since 2010, anything interest rate related has been taken to the woodshed.

So, I was just thinking, what if short- term interest rates have peaked (since the economy is anticipated to slow in the coming months)? Wouldn’t dividend related companies see a bounce from falling rates as the two have an inverse relationship? And from a defensive standpoint, if the economy does slow in the next quarter, wouldn’t dividend stocks catch a rotation?

Well, the investment thesis/fundamental picture is certainly interesting in $NLY. However, Annaly Capital’s strong technical setup is perhaps even more compelling. $NLY is on support of the 50 day moving average, is nearing oversold territory (according to the RSI), and is off more than 50% from its highs. With a sustainable, nearly 11% dividend, there is definitely enough incentive to buy this stock at these levels- despite the rising rate environment.

Update 4/10/2014:

Up again on another down day.

$NLY is firing on all cylinders as investors are flocking to safety ($NLY has a 10% dividend). Up 4% since the call.

[…] call to buy $NLY last week, a REIT with a safe 10% dividend. (note; We have realized a 5% gain in $NLY since publishing that article .) However, I see potentially bigger rewards from another two […]

[…] to buy $NLY last week, a REIT with a safe 10% dividend. (note; We have realized a 5% gain in $NLY since publishing that article .) However, I see potentially bigger rewards from another two […]