As the market is expecting to slow in the 1st quarter of 2014, interest rate sensitive names and safe haven plays, like dividend stocks and REITs, have started to gain some interest from investors lately. They were due for an oversold bounce anyway, if nothing else, as the recent new activity of the Fed’s tapering program has slammed dividend names (If interest rates rise, dividends and bonds lose).

So, to capitalize on this theme, I made the call to buy $NLY last week, a REIT with a safe 10% dividend. (note; We have realized a 5% gain in $NLY since publishing that article .) However, I see potentially bigger rewards from another two stocks..one is a tobacco maker with a 5% dividend in Altria ($MO) and the other is a tobacco company with a huge dividend as well in Lorillard ($LO).

Now, you may be asking, why tobacco companies? Well, they usually offer great dividends but were never exciting enough for me to buy. However, in keeping with our theme lately on the new E-Cigarette market, Lorillard ($LO) and Altria ($MO) are possibly the best ways to play the E-Cigarette trend because they are safer and more diversified than your average OTC E-Cig. penny stocks. So, let’s compare the two.

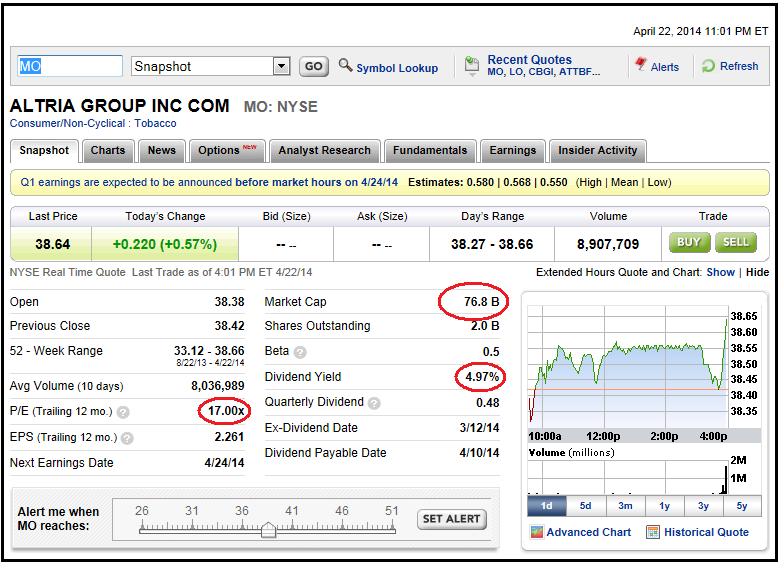

Altria $MO

Altria (Phillip Morris) trades at 17x earnings and has a 5% dividend (roughly). It has a bigger market cap than $LO at 76.8 billion.

Also, as I previously mentioned, both companies have made moves into the booming E-Cigarette business. I like Altria’s new acquisition of Green Smoke as well, a company that specializes in vapor products (E-Cigarettes) and cannabis products.

Altria is at its highs, though. There is previous resistance around $38 and it has been on a tear lately, going from $34 to $38, like that. It is also overbought on the RSI indicator. These combined factors must be kept in mind for $MO.

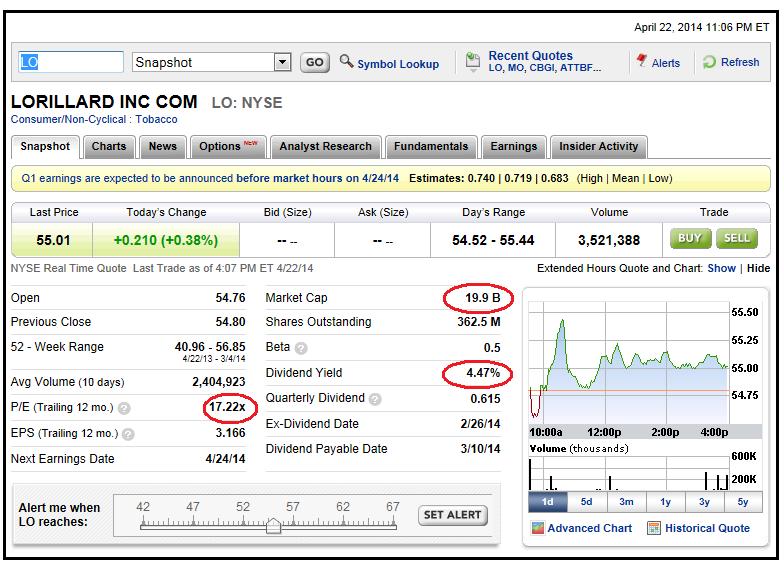

Lorillard ($LO)

$LO also trades at 17x earnings, has a 4.5% dividend, and is only a 19.9 billion market cap company (so there’s room to grow).

While Altria owns Green Smoke (E-Cigarettes & cannabis), Lorillard is content with its juggernaut in Blu, an extremely popular E-Cigarette brand. However, I don’t think that Blu specializes in cannabis products. Correct me if I’m wrong.

And, Lorillard as well as Altria, is at resistance and nearing overbought territory. So, my decision is final; I’m going to take a starter position in $MO once we get the dip. Since both companies match up evenly on the fundamental and technical side of things (both companies are at the same price at 17x earnings and both are at resistance), and because of the fact that Altria has a heftier dividend at 5% and is involved in the cannabis space, the decision to buy Altria ($MO) is really a no-brainer.

So, who would you buy? Feel free to post comments to the site and subscribe for trade alerts on $MO. Happy hunting!