We have already stated that we are neutral to short term bearish on this market for several reasons besides earnings season being in full swing:

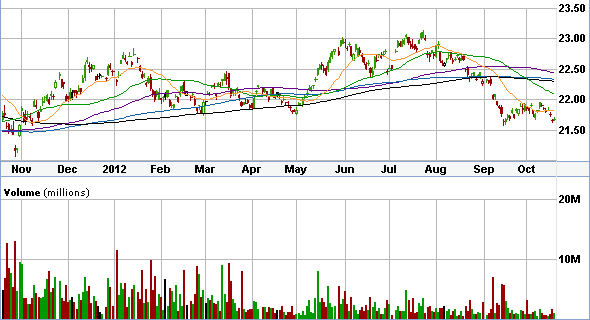

The dollar looks weak. It is at yearly support but is looking weak relative to the Euro, which is appreciating against the dollar due to the improving conditions from their austerity measures taken as of late. If the dollar goes down, as most people know, the market should have an inverse relationship and move higher. But, how much lower can the dollar go? Here is the dollar below.

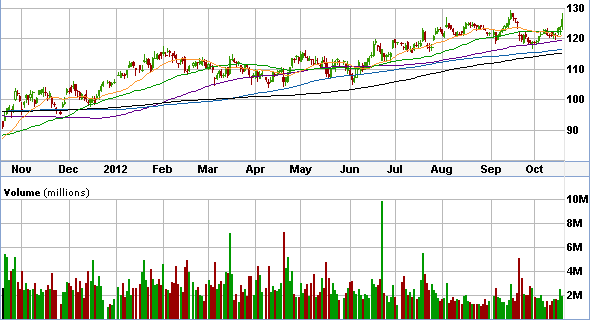

Secondly, transports need to be performing well in order for the economy to be healthy. Here you see Union Pacific (UNP) displaying a bullish trend, indeed. However, it is back at previous highs of 130.00 (much like the S&P 500 itself) which is a cause for concern. Here is UNP’s chart below.

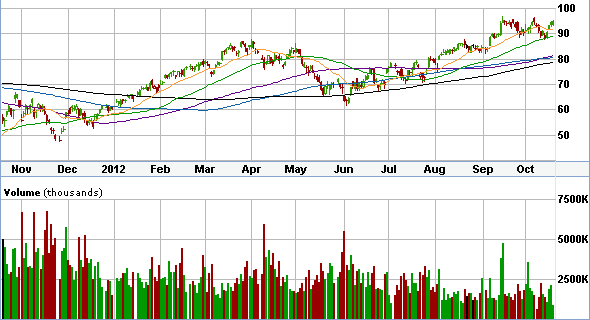

Lastly, the overall market (the S&P 500) is also showing a pretty strong uptrend as it is above all moving averages and seems to hold support when it finds it (the 50 day is a good example, green line). These technical developments have bullish implications and are not to be ignored. However, we are at previous highs so expect resistance at these levels. Here is the S&P 500 chart below.

With all of this being said, the conclusion we have drawn from these key indicators is that we are neutral on this market. We will not be doing any buying or selling until we get clear direction. Happy trading.