We already added a new name to the portfolio (mnst) this morning as we see positive signs of the overall market indexes improving. The S&P 500 is following through from the bounce off the 50 day 4 days ago. However, even though this is a positive development for the S&P 500, we are at the previous highs again from 4 weeks ago.

We already added a new name to the portfolio (mnst) this morning as we see positive signs of the overall market indexes improving. The S&P 500 is following through from the bounce off the 50 day 4 days ago. However, even though this is a positive development for the S&P 500, we are at the previous highs again from 4 weeks ago.

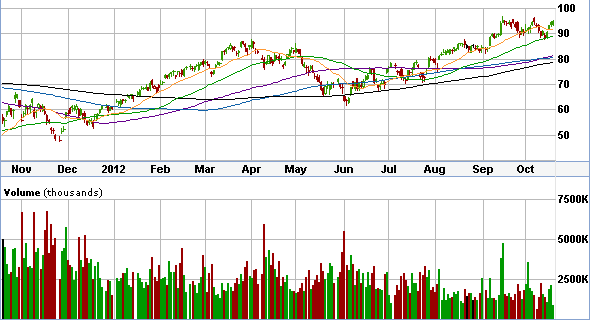

Expect resistance at these levels again in the short term. If this happens to be the top, which we have been fearing for quite some time but not necessarily expecting, a consumer non/ cyclical and healthcare play is what works here. So we added Monster Beverages to the portfolio as insurance against a fall in the market and for increased protection in a slowing economy- if we get one. Here is the S&P 500 chart below. Above all moving averages but at previous highs. As a result, we are neutral at the moment.

Disclosure: We stopped out of mnst Friday, Oct 19, 2012 at the 50 day moving average for a 7% loss.