Greetings fellow investors! Here is a wrap up of today’s action in the portfolio.

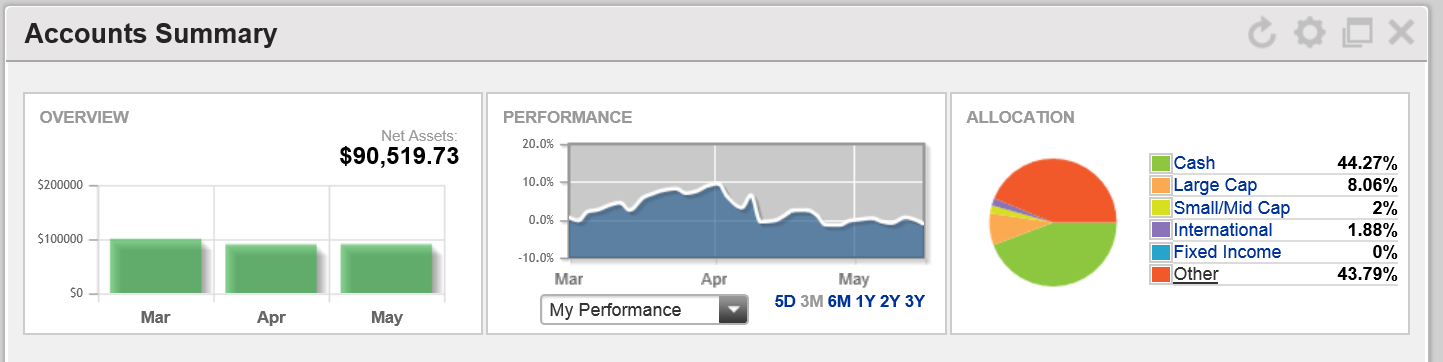

As you can see, the $SPY is looking constructive because it is above all moving averages and it is not overbought (according to the RSI). So why am I in so much cash? For one, I always keep a lot of cash on hand due to my particular investment strategy (50% stocks & UPRO : 50% cash). But, whatever your investment strategy is, it makes sense to be in high amounts of cash right now anyway, or at least to have your stop losses in place. Here’s why:

The 10-year Treasury is moving below the 2.5% mark (rates going down signals a slower economy ahead) despite the positive jobs, earnings, and macroeconomic data we have been seeing lately.

Secondly, the $IWM, (small-cap ETF which measures the health of small businesses as well as investor’s appetite risk) and any other stock that is growth or risk related, has been sold off relentlessly which suggests that investors are taking risk off of the table. Because the economy is possibly slowing, then interest rates won’t increase in the short term (which is why financials are underperforming).

And lastly, the $VIX is low. The old adage is, “When the VIX is low, it’s time to go.” So, extreme bottoms on the VIX usually coincide with extreme tops in the $SPY.

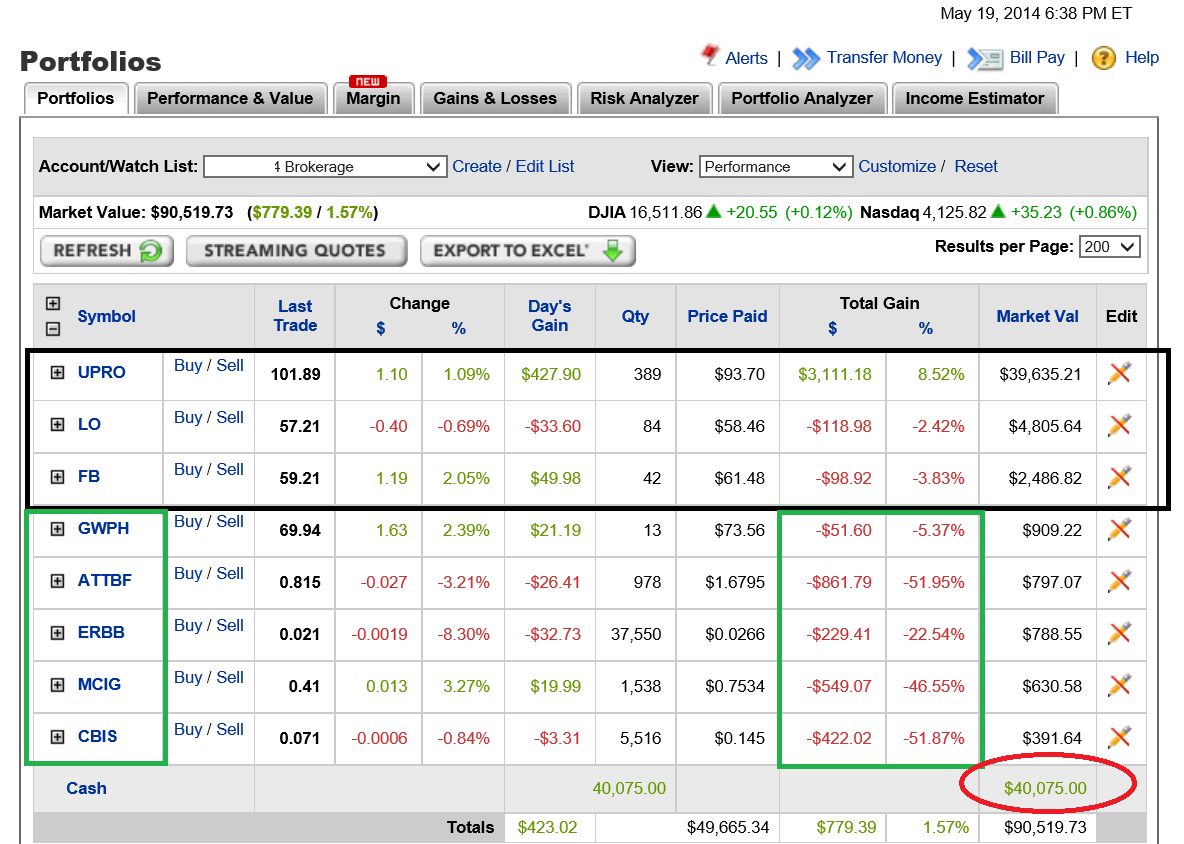

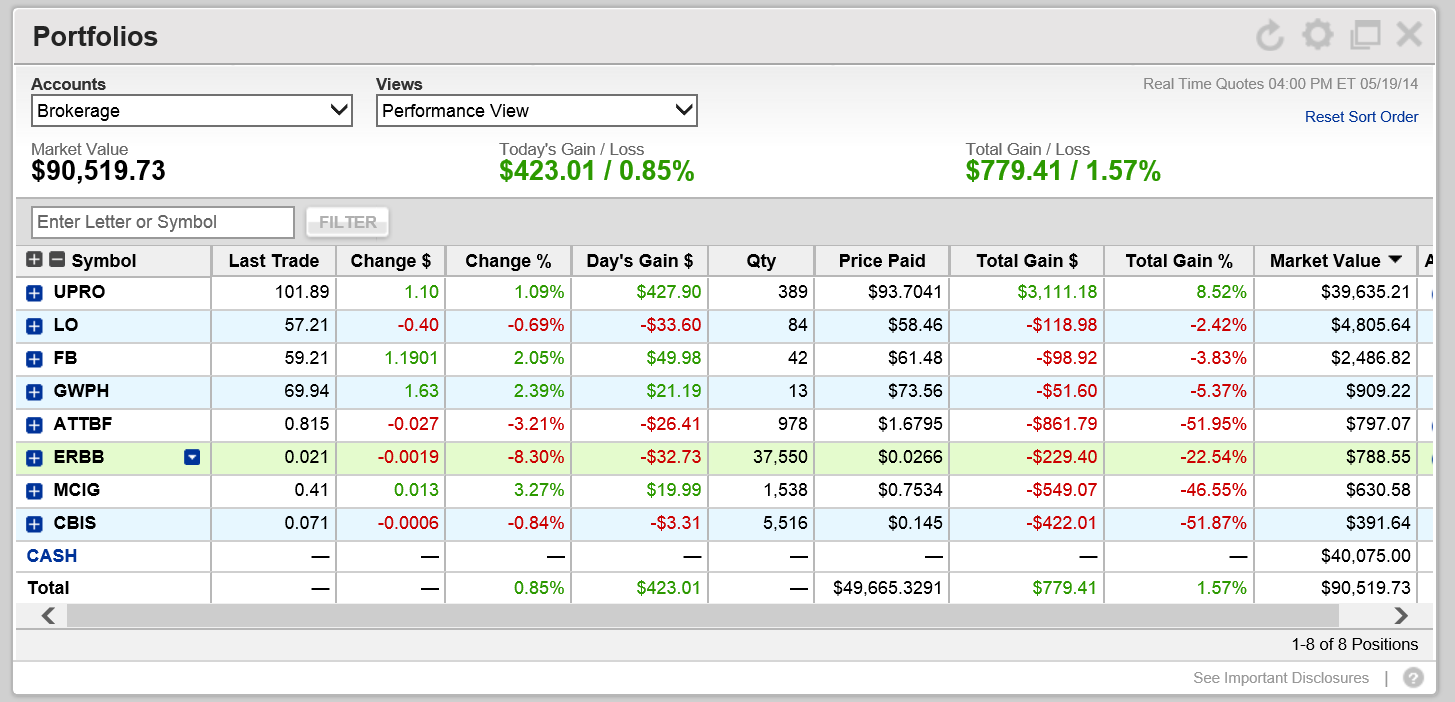

Portfolio As Of May 19, 2014

Now, as you can see, my portfolio is back to break even for the year. Considering I have spent approximately $10,000 for the year on traveling and living expenses, the marijuana stocks have given back all of their gains, and the market has been volatile for the entire year, shooting par in this world is pretty good (famous words from Martin Sheen to his son in ‘Wall Street’). In fact, a lot of fund managers are down YTD. Jim Cramer is down 3% in his widely publicized “Action Alerts Plus” portfolio.

However, I think we can still get a 6-8% return in the S&P 500 ($SPY) in 2014. So, I have positioned myself accordingly:

In conclusion, the plan going forward is to keep a healthy amount of cash on hand to take advantage of opportunities where we see fit. (This may explain why I am down to only 3 positions; I won’t count the 5 cannabis stocks unless they become bigger positions.) Remember, keep your current positions on if they are working, just make sure you have your stop losses in!

I plan to pick away at the cannabis stocks when they start looking constructive again. I added to ERBB today, actually, on its 200 day mavg.

I will add to Lorillard $LO on any weakness because it is my income generator for the portfolio as well as a defensive hedge (it has a hefty 4% dividend and is non- cyclical).

Lorillard $LO, the tobacco producer, has had a nice run and is now on the 20 day mavg.

Of course, I will be adding aggressively to the S&P 500, or $UPRO, on any weakness (I am using this 3X ETF in $UPRO because I am young. If you are not comfortable with a triple, try $SSO the double, or just the single in $SPY). Either way, you should always have the S&P 500 somewhere in your portfolio.

And Facebook $FB is my third position. I am holding this stock based on its growth prospects and positioning in the social networking space. My target is $75 but, due to rotation out of growth stocks into dividend-paying names, at the moment, Facebook is in a holding pattern.

I will alert you via email when I make the next move.

Thank you, again, for your visiting Wallstreetstocksolutions.com. I will continue to work as hard as I can to make us both a success in this market.

Sincerely,

Todd Akin

Update May 21, 2014: $LO Up 11% On Merger Deal

LO Up 11% in one day on takeover speculation.

Update S&P 500 Moves 3% Higher