It doesn’t take a genius to be able to read a chart. This is all you need to know: the trend is up, but we are at short-term resistance. Will SPY fail this level or simply push right through it? Well, investors want in on this market but are scared to chase it. So, they wait for a pullback but never get it. Know why? Because no one is willing to sell.

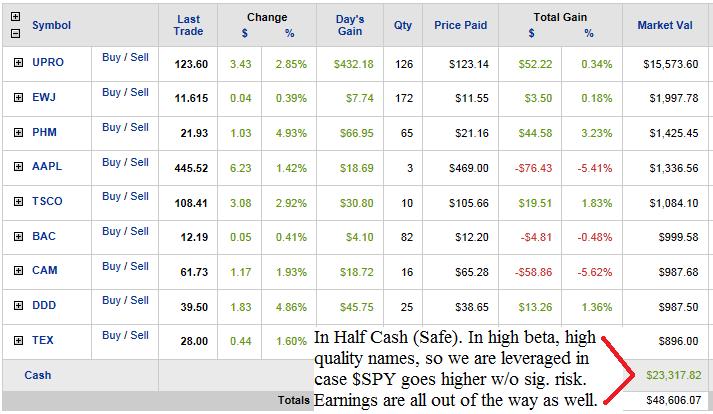

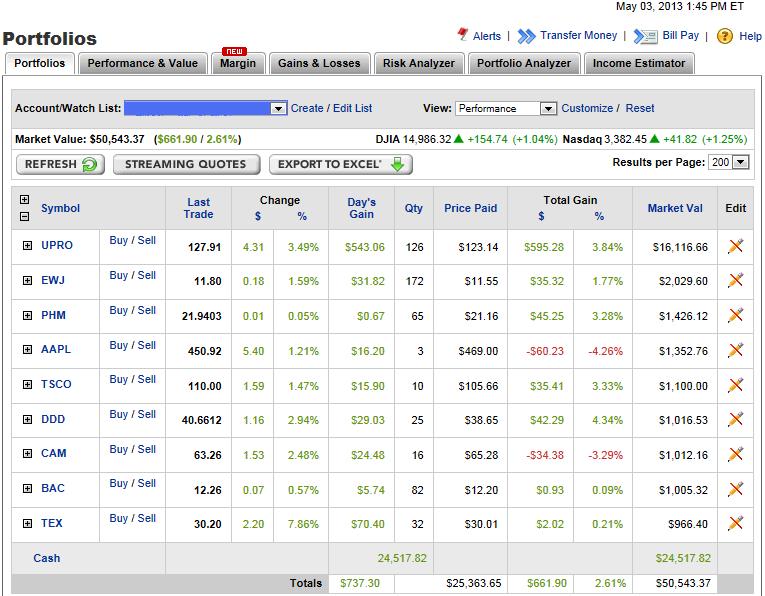

Take my portfolio for example. Tomorrow, job’s numbers will come out which could give traders the excuse they needed to sell, since SPY (S&P 500) is at resistance. But I am in half cash (which is extremely conservative), so I have no reason to be selling what little stock I have left.

After all, I have to be invested somewhat right? (Because it is called investing, not trading).

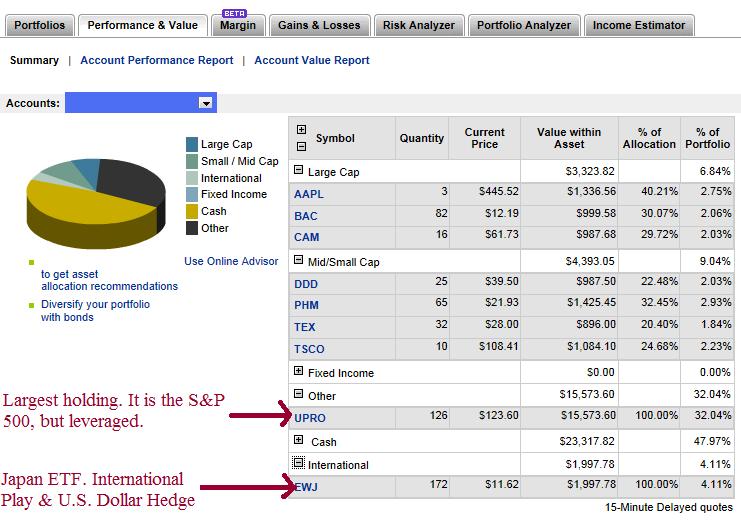

I figure this is what most fund managers are doing as well unless they are fully invested at these levels (which is wreckless). So, I just spread out my risk through diversification, take more interest into the laggards (cheap stocks), and go long-term. That is the way to do it.

But, here is the riddle: I am waiting in half cash for the pullback yet I am perfectly positioned in high quality, high flying stocks should the market move higher. Rarely is investing this easy and comfortable. That is why I think we go higher tomorrow, and I miss out on making more money than I could have made. But, if we go down, no problem! (Because I am in half cash, so I can’t get hurt and I just get to buy more quality stocks at a discount.)