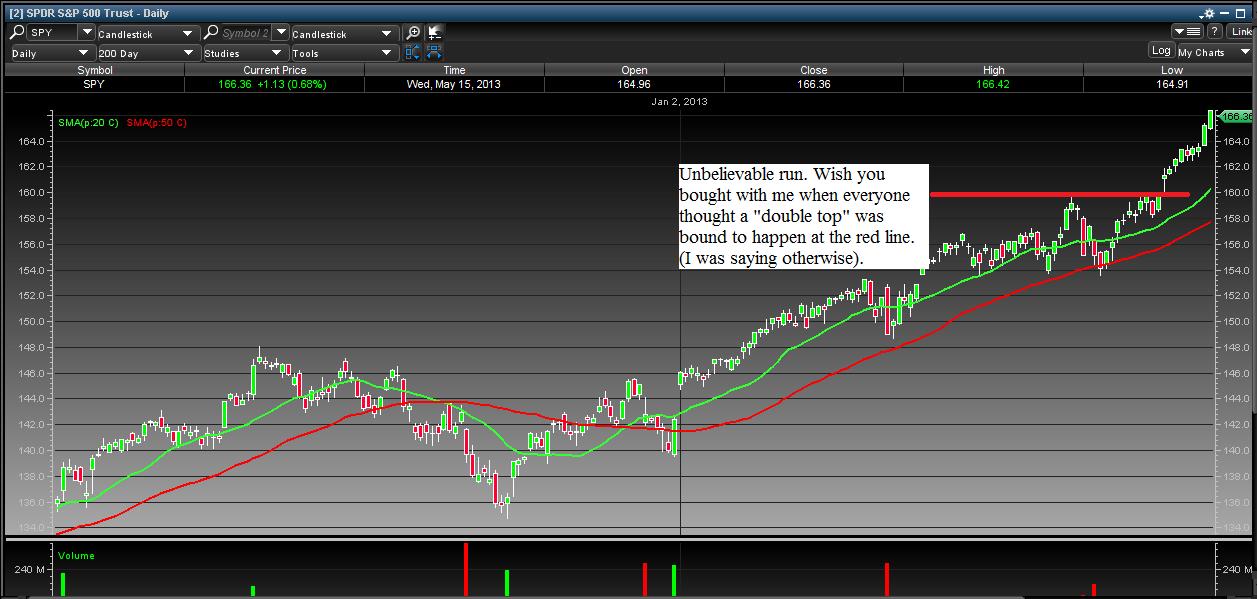

It hasn’t been since the late 90’s that stocks have seen gains like these. We got similar returns in 2007 but those, as you know, were predicated on bubble mentality. The cycle we are experiencing now is comparable to the 1950’s-1960’s after the market emerged from the ashes of WWII, they say. What’s more, investors feel this bull market can continue for years to come, and this is just the beginning.

I will tell you why this market is working if you don’t already know (or if you don’t follow me on twitter).

1.) Interest rates are low, pushing investors into riskier assets where they can actually get a return for their money. (Bonds, cd’s, savings accounts- none are worthwhile when earning 1% or less a year.) Of course, you can go into longer duration or higher yielding bonds, but many believe a bond bubble is coming as the fed keeps printing money and is forcing interest rates down- leaving rates no where to go but up (negative for bonds).

2.) Speaking of the fed, it is not only the federal reserve pushing for an accomadative policy, other central banks around the world are practicing the same concepts. So, in effect, you have a backstop put in place if economies around the world should slow. We are being forced into stocks people. If growth slows, we get more monetary easing (good for stocks). If we grow, monetary easing will stop but stocks will still benefit because…the economy is growing.

3.) Stocks are still cheap on every metric you look at (price to earnings, price to book, etc..). We are valued currently at around 14x earnings when, historically, the mean trades at 16-18 times earnings. Just trust me, stocks are cheap- still.

4.) The list goes on but I will end with this: Usually after runs like these in the stock market everyone and their grandmother begin to hand out stock tips as they are filled with excitement. But, everyone is skeptical of this rally. Also, 50 percent of the retail investor is still on the sidelines & money has not yet rotated out of bonds. This means we have a long way to go before calling ” the top” in this market.

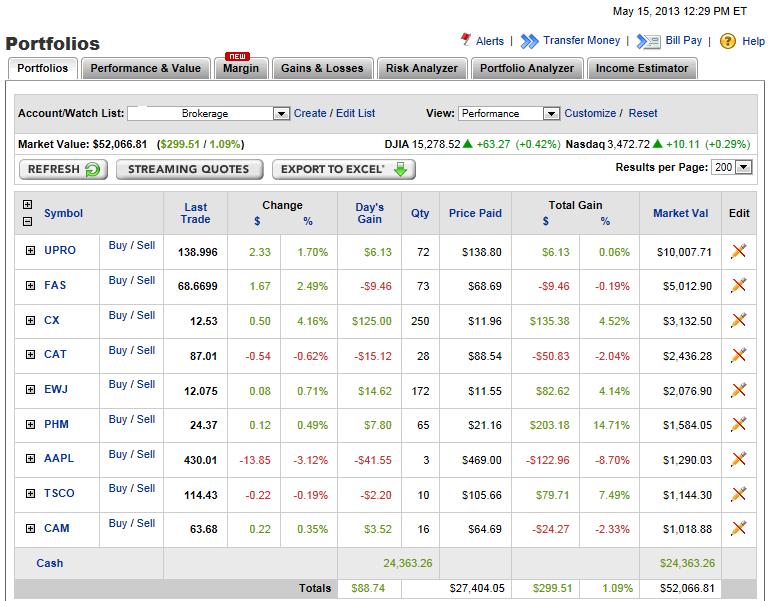

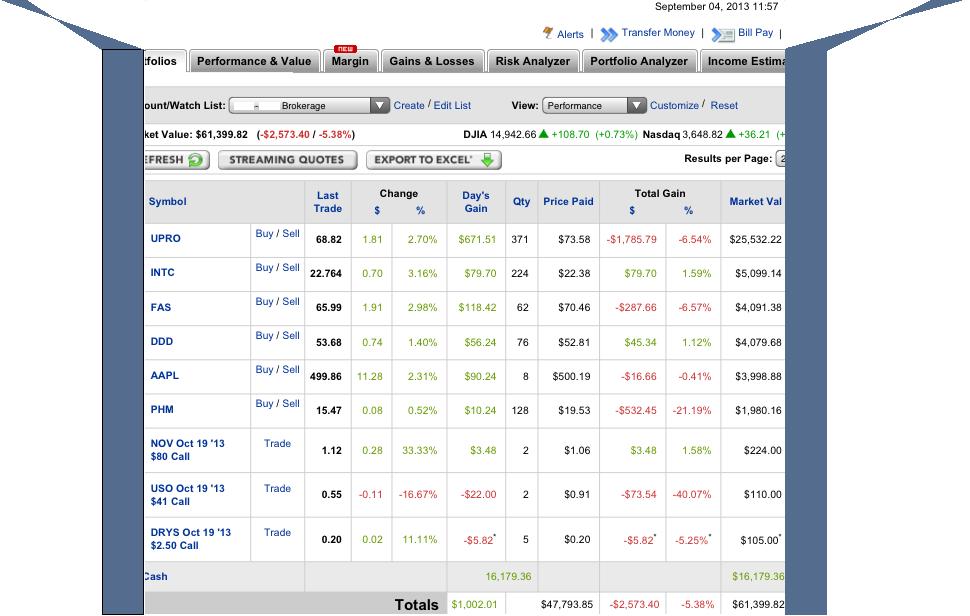

Of course, I enter/exit stocks frequently in order to trade around core holdings. As a result, the % gains/losses you may see are not indicative of actual portfolio performance. Use the market value total (bottom right) as your proxy.