There is an imminent market crash looming over our heads at this very moment…At least, that’s what the pundits are saying. I, on the other hand, have a different take on the market (as you might know if you follow me regularly).

To be fair, let’s breakdown the bear’s argument first: Interest rates are rising and our economy can’t handle the shock. Or, how about the article out of Seeking Alpha yesterday which noted that three major indicators: the advance/decline line, money supply, and copper are all at levels akin to that of 2008 before the great crash. There is also the fact that the U.S. is facing another debt ceiling showdown and China is shaky, as always. Ok, all noteworthy points.

But, what ever happened to validity in the marketplace? Most of the arguments I hear coming out of the bear camps are flawed. The market landscape has changed dramatically over the last 5 years so the similarities bears are finding from pre-crash levels simply don’t apply today. We have corrected the major problems that led to our downfall in 2008. (Loose lending practices, a housing / jobs free fall, toxic balance sheets, bank stress tests, to name a few).

We are now a more resilient market than ever with a thicker hide. Even 5% corrections are hard to come by. Sure, a 10% correction would be great and therapeutic but too many positives are underpinning this bull market (low interest rates, healthy stock valuations, pristine corporate balance sheets, a housing/jobs recovery, the manufacturing renaissance in the U.S., and the energy boom).

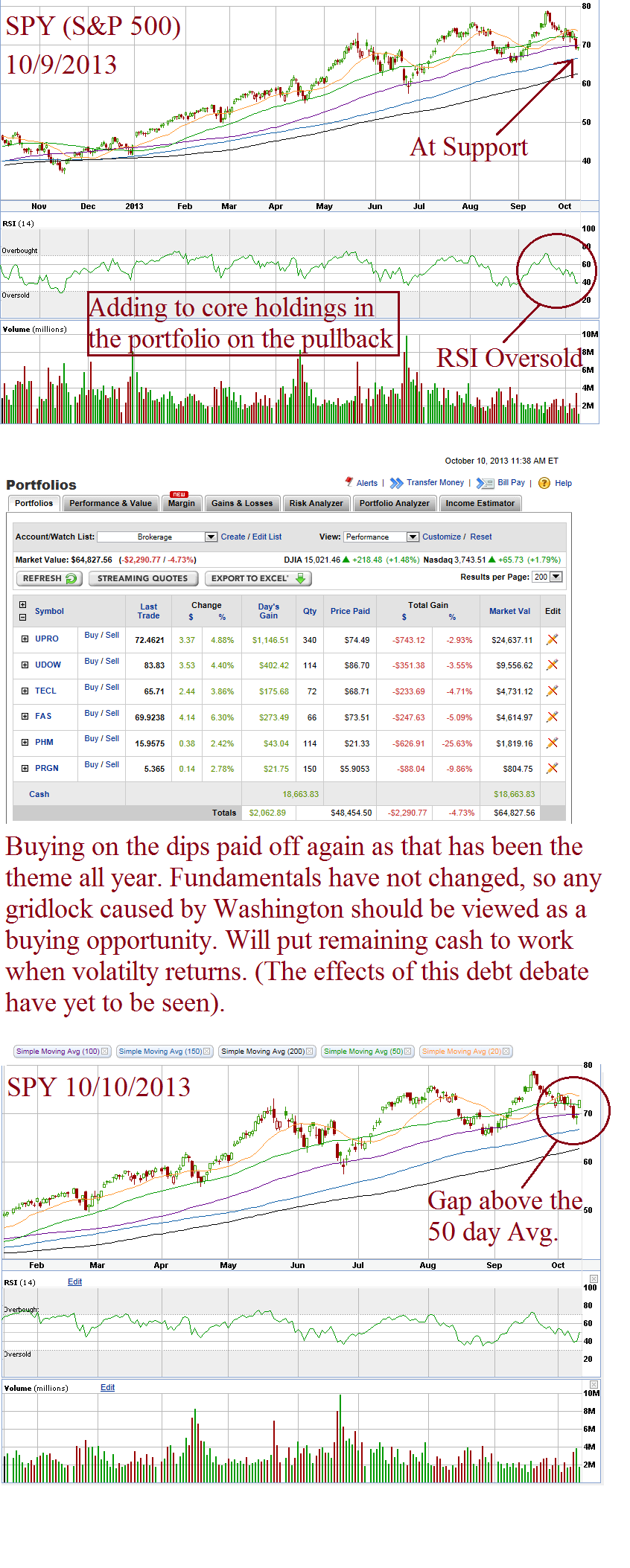

Yes, this has been the bull case for years now but, at the end of the day, where else can you put your money and get a return? (Still, no where- except stocks). And how can I ignore the technicals? The S&P 500 uptrend remains intact, as seen below.

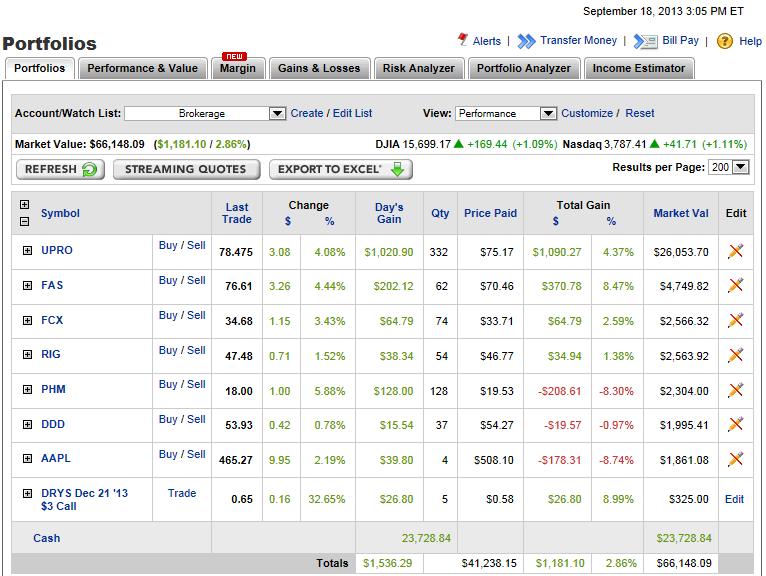

Update: SPY Chart. Positive Fed Reaction.

Here is how the portfolio performed after the Fed announcement.

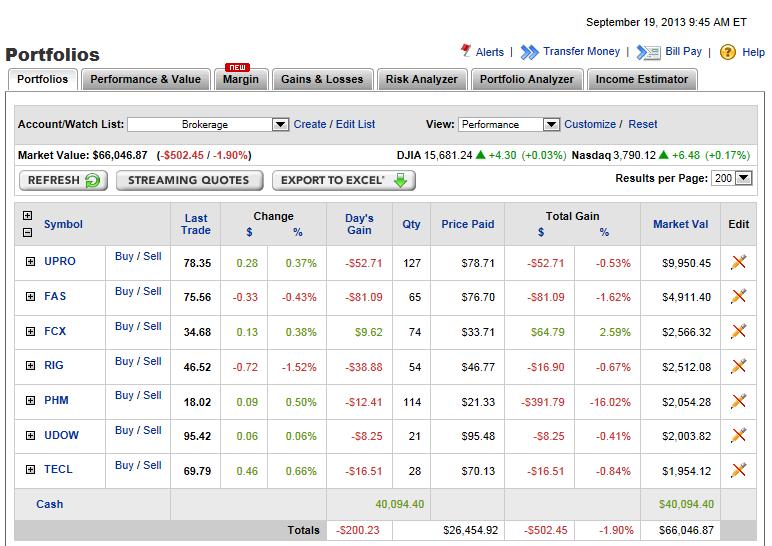

Time to re-balance the portfolio as a result.

In over 50% cash. Content with letting the market come in some before putting more money to work. Here is my take on the Fed: The economy is not strong enough for tapering yet. (We have to reach 6.5% unemployment and better GDP growth, first). Equities are still the place to be long-term with interest rates being so low, but the market is going to have to grapple with this Fed hangover short-term.