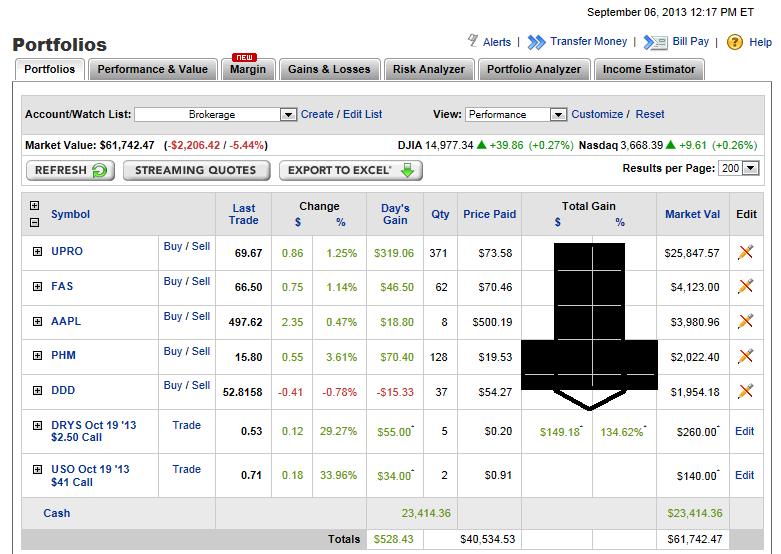

I don’t want to own anymore than 5 stocks at the moment because the market is looking shaky. So, what do I do when I want to own the perfect stock- DryShips Inc. but can’t because you’re scared to take any more risk?

Buy the option. You don’t just buy options at any given time, though; the stars need to align first before you do. In this case for DryShips Inc. (DRYS), they did.

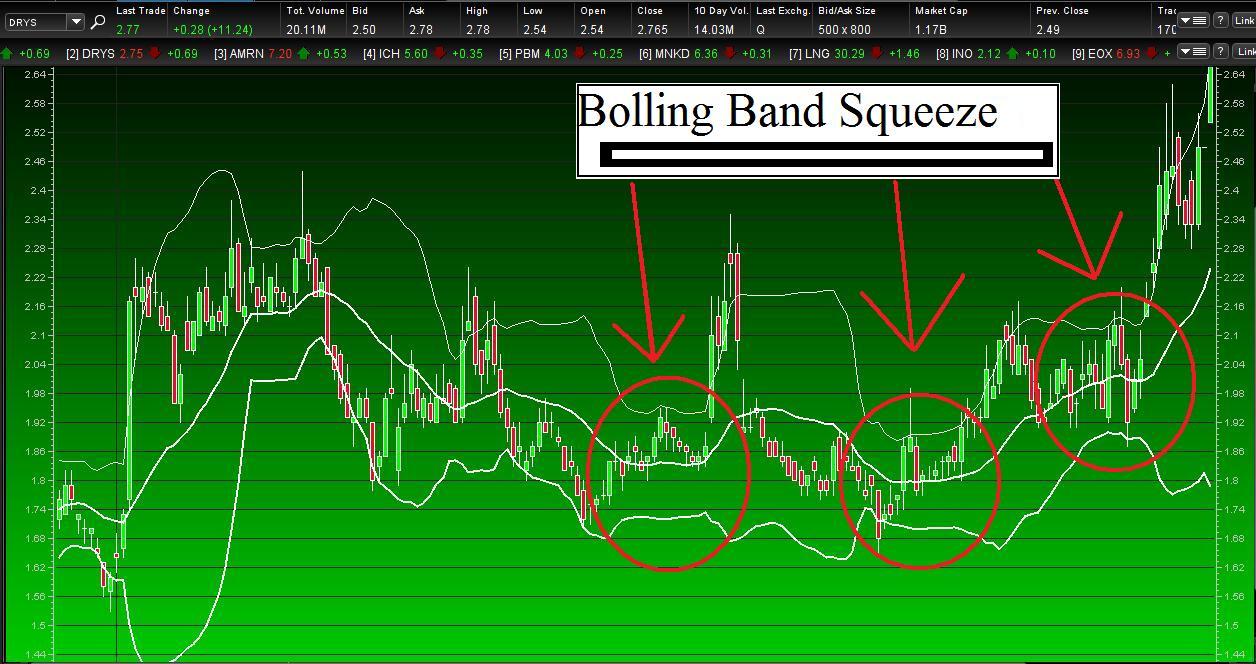

Let’s go through it. First of all, DRYS had a sound technical setup on the chart. I mean, they don’t get much better than this- a breakout above all moving averages after being in a bear market for three years. We also got a squeeze out of the Bollinger Bands and good volume to confirm as well.

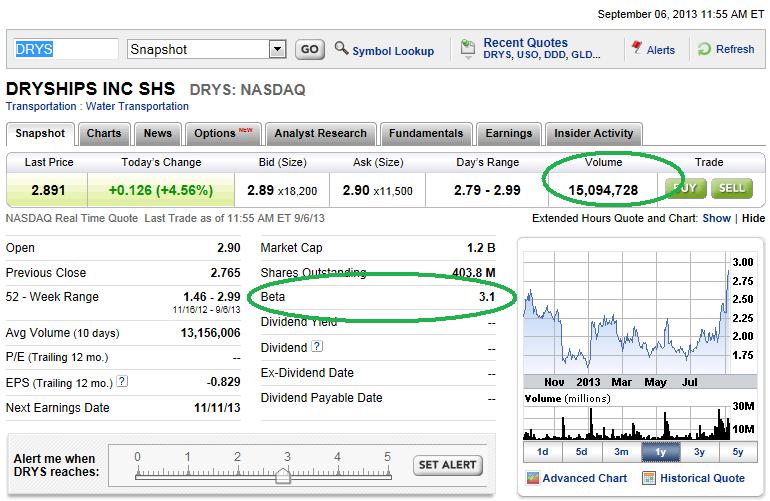

Secondly, options need volatility or risk in order to work. Huge companies like Coca-Cola, Wal-Mart or Microsoft, don’t move enough to use options. DRYSHIPS, on the other hand, is in a sweet spot for an option play. It is only a 1.1 billion market cap company, so it’s small enough to make a move.

Remember, DryShips Inc. and the other shipping stocks were all high-flyers before the financial crisis in 08′. Look at it’s beta- over 3! (Anything over 1 is considered to be on the volatile or risky side). It also has no dividend, so owning the stock won’t provide you with any added benefits. Last, but not least, it is liquid so you can get in & out (over 15 million shares traded today).

Lastly, the fundamentals are actually improving for the shipping industry. China seems to have stabilized around the 7% GDP level and the U.S. and Europe continue to improve. DRYS management was”cautiously optimistic” on their recent earnings call but, that’s a good sign. It’s better than the “pricing remains in a downward spiral” or “margins are suffering” which the shipping industry has lamented over for the last five years. In fact, things are going so well at home that the fed is actually deciding to raise interest rates.

So, I bought DryShips Inc. I took it for a ride earlier on the breakout from 2 to 2.50 and got back in on the pullback at 2.45. I will most likely exercise the option at $2.50 when it expires in October because I think this sector has legs and would be profitable to go long on. It may well be the beginning of a new bull market in shipping stocks. Best of all, I have defined my risk in DRYS because I am just using the option, not putting up all of my money to buy the stock. In essence, you are buying a lottery ticket with great odds if it works…and it did! What can I say? Sometimes, the market gods are good to you.

Update:

Update: Re-entering DRYSHIPS

Sold the October 21′ 2.50 calls for over a 100% gain and switched into the December 21′ 3.00 calls based upon a strong 1- day technical setup and for practical reasons. See here how DRYS held the 38% retracement level (purple line) and moved higher? This was my signal for re-entry. The December 21′ 3.00 calls give DRYS more time to work than the October 21′ 2.50 calls. This makes them more expensive but, buying them further out of the money at 3.00 makes the price come down some. I intend on adding to the DRYS 3.00 December 21′ calls on any significant pullback.